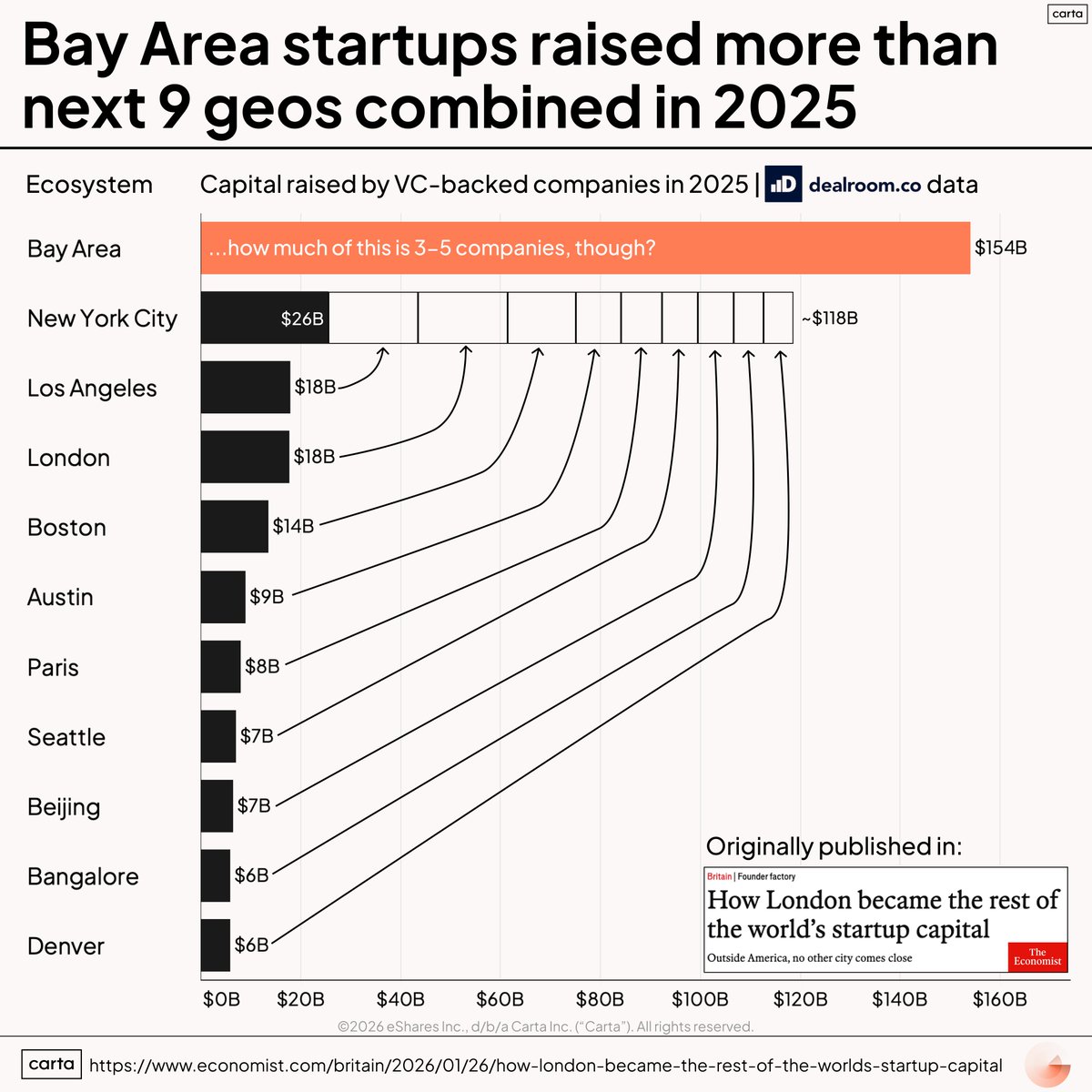

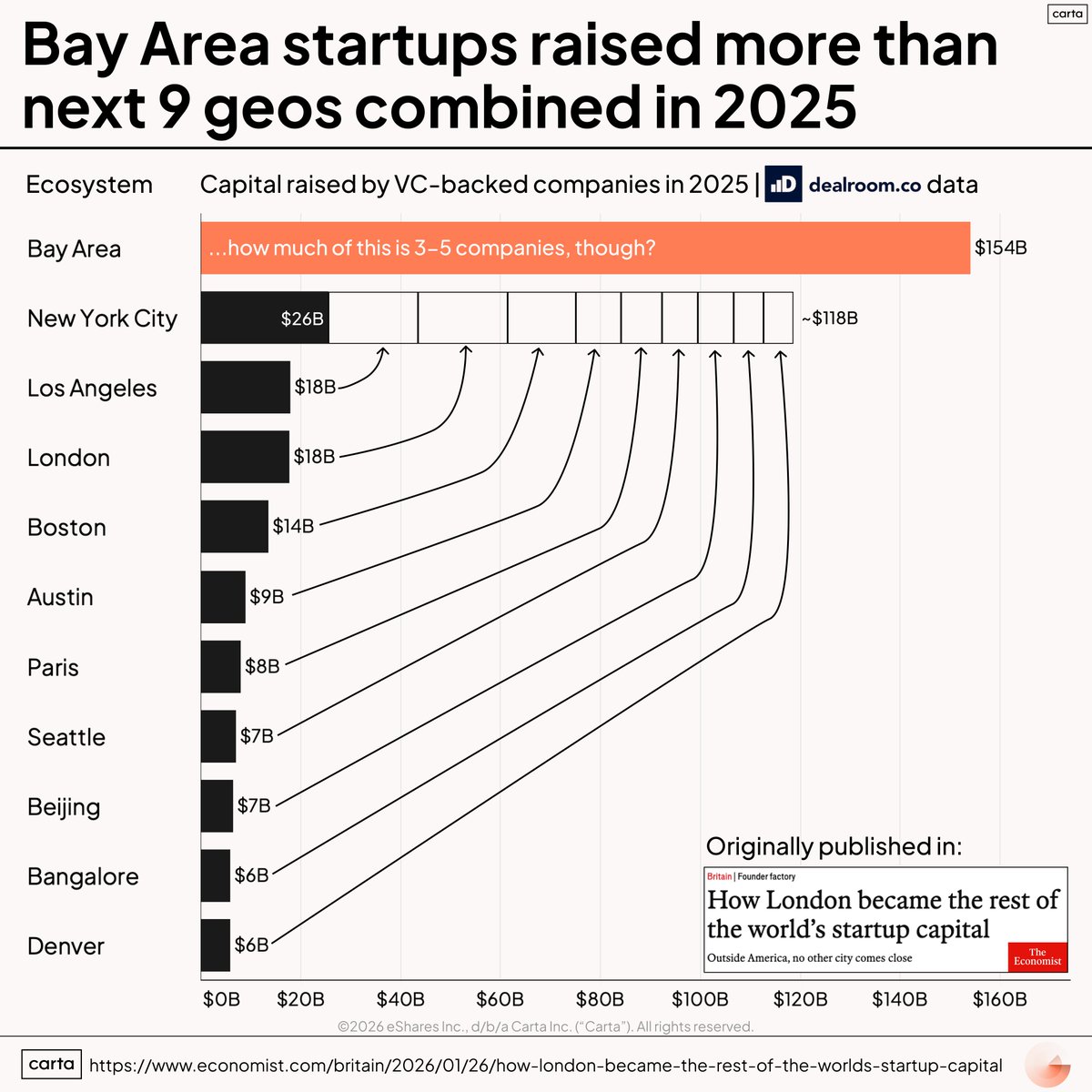

Bay Area is the $154B Startup Ecosystem Golden Goose. Sacramento Wants to Kill It.

The numbers prove SF is the undisputed capital of innovation. So why are California politicians hellbent on driving it away?

California politicians are considering policies that could kill the Bay Area's $154 billion startup ecosystem—the largest in the world—while San Francisco's union-backed "CEO tax" heads to the June 2026 ballot with an 800% gross receipts tax increase that doesn't actually tax CEOs. With one-third of downtown SF still vacant and major companies like Stripe and Square already fleeing due to crushing tax burdens, these policies could determine whether the next generation of tech giants are built in California or somewhere else.

The numbers prove SF is the undisputed capital of innovation. So why are California politicians hellbent on driving it away?

SF Chronicle says murals can revive empty buildings. Meanwhile, the city's about to make it impossible to do business downtown.

It doesn't tax CEOs. It's an 800% gross receipts hike that hits Safeway shoppers while executives pay nothing.

Unions want an 800% tax increase disguised as class warfare—and they're breaking a deal they made just last year.

Labor coalition wants an 800% tax hike while 1/3 of downtown sits empty. They're breaking the deal they made last year.

Founders are already planning their escape routes. YC's strategy: leave after Series B, go distributed. "Suboptimal, but we know how to do this."