Red Robin Died by Spreadsheet. Don’t Make the Same Mistake.

This restaurant chain’s 96% stock collapse is a warning for every company facing the AI age

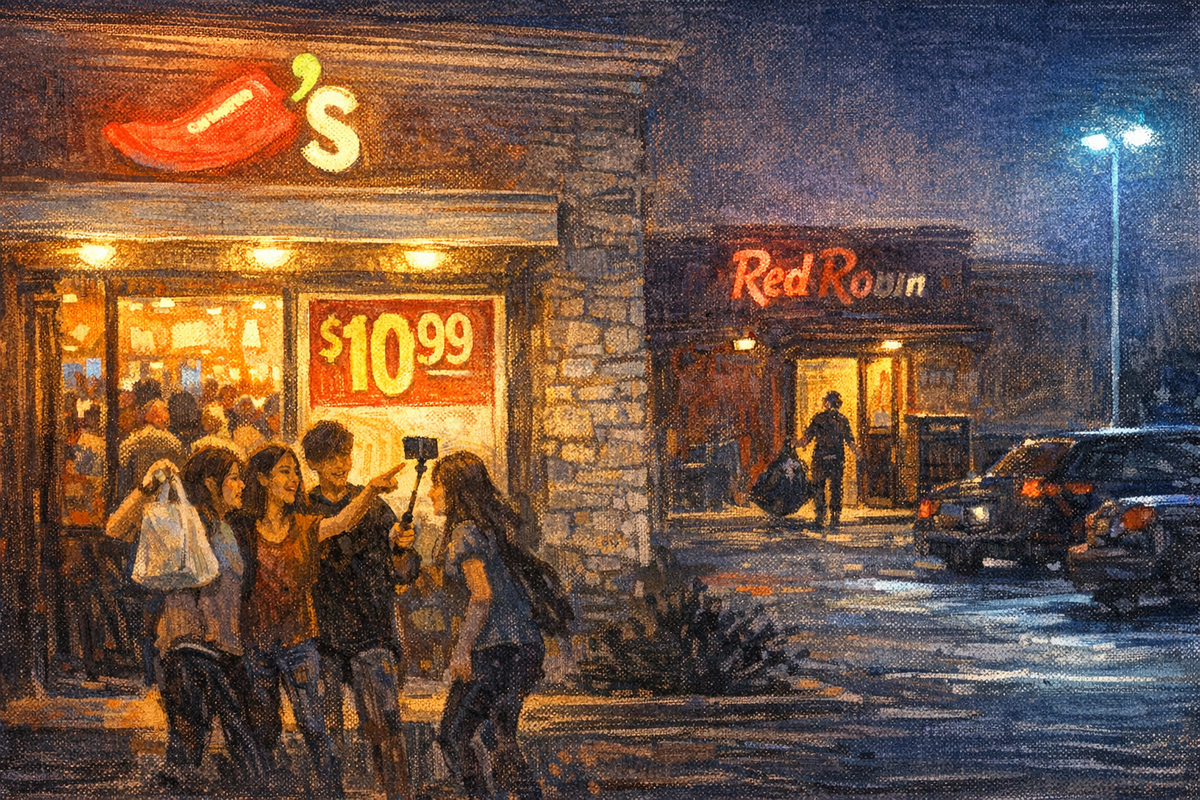

Red Robin's stock collapsed 96% after management eliminated bussers and support staff to cut labor costs — while Chili's invested in customer experience and posted 31% same-store sales growth, a 50x market cap difference that illustrates what happens when companies optimize for quarterly earnings instead of the customer walking through the door.

Source: garryslist.org

Red Robin's stock collapsed 96% after management eliminated bussers and support staff to cut labor costs — while Chili's invested in customer experience and posted 31% same-store sales growth, a 50x market cap difference that illustrates what happens when companies optimize for quarterly earnings instead of the customer walking through the door.

Source: garryslist.org

TL;DR

Red Robin’s stock collapsed from $92 to $3.61 after management fired all bussers to save on labor costs. Meanwhile Chili’s invested in customer experience and posted 31% growth. The lesson for the AI age: always look to do more.

The fear of the future is directly proportional to how small your ambitions are. If your plan is to keep doing exactly what you’re doing, any change is terrifying. If your plan is dramatically bigger, change is the best news you’ve ever gotten.

Red Robin just proved it in the public markets. Their stock collapsed 96% because management chose the spreadsheet over the customer. That’s what happens when you optimize for the 1.05x present instead of the 10x future you could be building.

Archived tweetThe race to the bottom is a real effect https://t.co/CSVyNuI1Z1 [Quoting @aakashgupta]: Red Robin is a case study in how to kill a restaurant chain from the inside out. In 2015, the stock hit $92.90 per share. Revenue peaked in 2017 at $1.4 billion across 573 locations. Families loved the place. Bottomless fries. Birthday parties. “Gourmet” burgers when that word still meant something in casual dining. The brand had real equity. Then management panicked about rising minimum wages and made the single worst decision in the company’s history: they fired all the bussers. January 2018. CEO Steve Carley cut bussers across every location, eliminated expeditors, and replaced kitchen managers with generic “back-of-house” roles. The logic was pure spreadsheet thinking. Labor costs were rising, so remove labor. The savings looked great in quarterly earnings. The second and third order effects were catastrophic. Tables stopped getting cleared. Wait times ballooned. Walkaways increased 85% year over year. 75% of the dine-in traffic loss came during peak hours, the exact window when the restaurant makes money. Ticket times out of the kitchen jumped a full minute on average. Customers who waited 20 minutes for a table and another 20 for a burger stopped coming back. Red Robin’s own CEO at the time, Denny Marie Post, admitted the damage was self-inflicted. And here’s the compounding problem. While Red Robin was gutting its own service model, it simultaneously launched a “Tavern Double” value menu at $6.99 to drive traffic. Orders of the cheap burgers jumped from 9% to 15% of all orders, which cratered the average check. So Red Robin was now serving worse food, slower, in a dirtier restaurant, at a lower price point. That combination is how you enter a death spiral. Meanwhile, 16% of locations were in malls. Mall traffic was already declining. Those locations saw 5.5% sales drops versus 3% at standalone stores, dragging the whole system down. Management acknowledged the problem quarter after quarter and did nothing about it for years. Five CEOs in 10 years. Think about that. The one leader who provided stability, Michael Snyder, was with the chain from 1979 to 2005. After that, it was a revolving door. Every new CEO launched a new turnaround plan. Every plan was abandoned by the next CEO. The North Star plan. The First Choice plan. New menu rollouts. Loyalty program reboots. None of it addressed the core issue: they’d trained an entire generation of customers to think of Red Robin as the place where the service is terrible. The contrast with Chili’s makes the failure even clearer. Kevin Hochman took over Chili’s in 2022 and did the opposite of what Red Robin did. He simplified the menu, invested in operations, launched a $10.99 “3 for Me” deal that went viral on TikTok, and let the food speak for itself. Chili’s just posted 31% same-store sales growth. Red Robin’s comparable revenue was down 1.2% for all of 2024. Both chains were in roughly the same position three years ago. One chain invested in the customer experience. The other spent a decade cutting it. Red Robin’s $65M market cap and Chili’s $3.3B market cap tell you which approach works. The stock went from $92 to $3.61. That’s what happens when you optimize for the quarterly earnings call instead of the customer walking through the door.

Garry Tan @garrytan February 20, 2026

The Death Spiral of Small Thinking

In January 2018, Red Robin CEO Steve Carley made a decision that looked brilliant on the quarterly earnings call. He fired all the bussers. Eliminated expeditors. Replaced kitchen managers with generic “back-of-house” roles. This was what seemed obvious at the time: Labor costs were rising, so remove labor. The savings showed up immediately.

The second and third-order effects were catastrophic.

Tables stopped getting cleared. Wait times ballooned. Walkaways increased 85% year over year. 75% of the dine-in traffic loss came during peak hours, the exact window when restaurants make money. Ticket times jumped a full minute on average. Customers who waited 20 minutes for a table and another 20 for a burger stopped coming back.

They ran through five new CEOs in 10 years. Every new CEO launched a new turnaround plan. Every plan was abandoned by the next CEO. The North Star plan. The First Choice plan. Menu rollouts. Loyalty reboots. None of it addressed the core issue: they’d trained an entire generation of customers to think of Red Robin as the place where service is terrible.

Chili’s Chose MORE

Kevin Hochman took over Chili’s in 2022 and did the opposite of what Red Robin did. He simplified the menu. Invested in operations. Launched a $10.99 deal that went viral on TikTok. Let the food speak for itself.

Chili’s just posted 31% same-store sales growth. Red Robin’s comparable revenue was down 1.2% for all of 2024.

Both chains were in roughly the same position three years ago. One chain invested in the customer experience. The other spent a decade cutting it. Red Robin’s $65M market cap versus Chili’s $3.3B tells you which approach works. 50x difference from the same starting point.

This Is the Choice of the AI Age

I wrote about this in Boil the Oceans. We’re at an inflection point where the old playbook, eking out 5% efficiency gains, increasing profit margins 2% by lowering cost and firing people, isn’t just insufficient. It’s suicide.

The new question is: what would it look like to build a product or service so good that people would happily pay 10x what they pay now?

If your plan is to keep doing exactly what you’re doing, AI is terrifying. If your plan is to do something dramatically bigger, it’s the best news you’ve ever gotten.

Jevons Paradox Doesn’t Activate Itself

When you make a resource dramatically more efficient, you don’t use less of it. You use vastly more. Steam engines didn’t reduce coal consumption. They made coal so useful that demand exploded.

The same thing is about to happen with intelligence, with labor, with every service and product we can imagine. But Jevons Paradox doesn’t activate on its own. It requires capital and management to actually raise their ambitions.

Red Robin chose to drown in committee. Chili’s chose to boil the lakes.

The lesson for the AI age: at this moment we could work to do MORE, do it better, or we can cut costs. Cutting costs is a race to the bottom. Red Robin proved it.

We have to choose MORE. Boil the oceans. For pointy haired manager-mode CEOs, this is a real fork in the road. For founder-mode builders, it’s pretty obvious what you should do. It’s not even a question.

Related Links

-

Boil the Oceans - Garry's List (Garry's List)

-

Aakash Gupta's Red Robin Analysis (@aakashgupta)

-

Red Robin Stock Collapse (@TripleNetInvest)

Comments (0)

Sign in to join the conversation.