The Real Class War California Won’t Talk About

Inherited wealth wants to destroy builders while protecting their own loopholes. The data exposes the fraud.

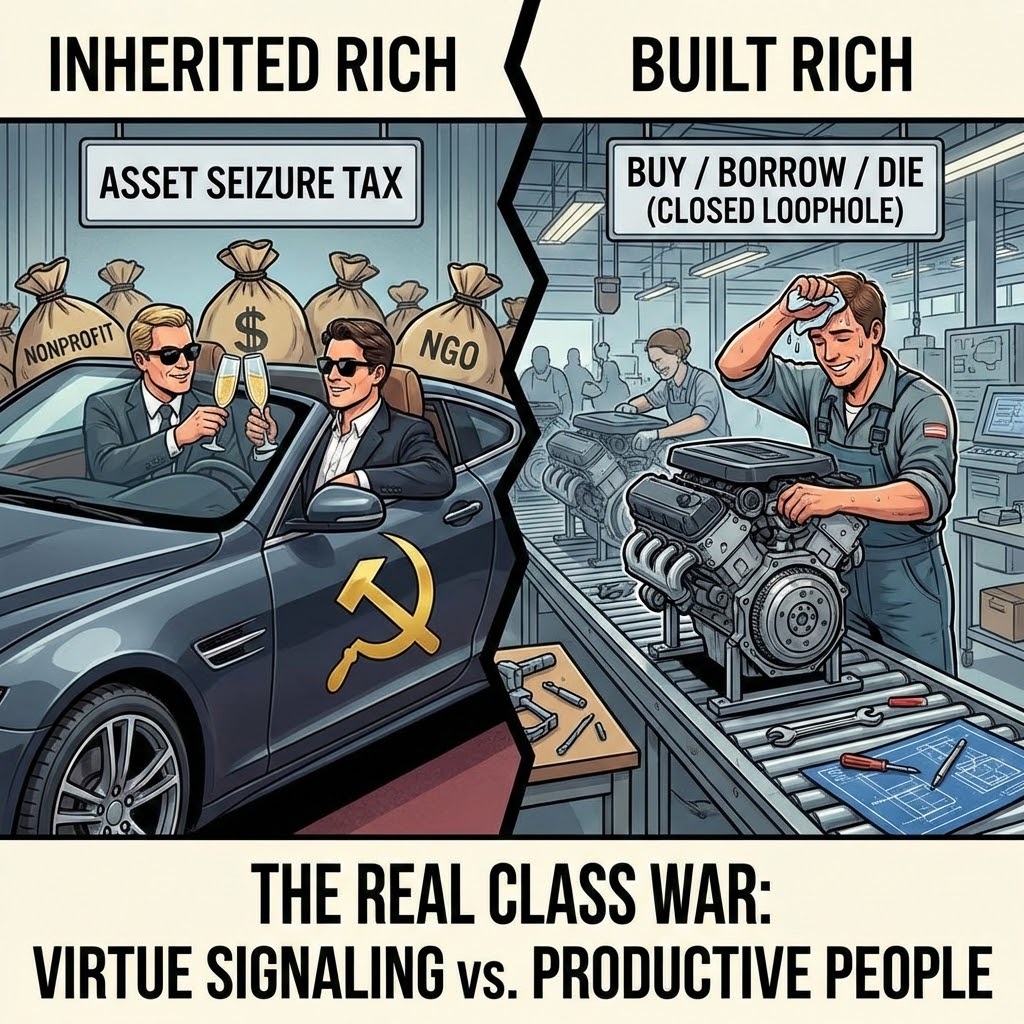

The contrast says it all: inherited wealth toasts champagne while working people build engines. This is the real class war playing out in California's tax debates—and it's the builders who are under attack. Image: @garrytan tweet

Source: x.com

The contrast says it all: inherited wealth toasts champagne while working people build engines. This is the real class war playing out in California's tax debates—and it's the builders who are under attack. Image: @garrytan tweet

Source: x.com

TL;DR

Asset seizure taxes target self-made entrepreneurs while the real loophole—buy/borrow/die—lets inherited wealth coast forever. 9 of 10 top billionaires are self-made, and there’s a smarter fix that progressives refuse to support.

California’s proposed wealth taxes aren’t about closing loopholes for the mega-rich—they’re about punishing anyone who builds something from nothing. The real class war isn’t rich vs. poor. It’s inherited wealth vs. built wealth.

The Real Class War You’re Not Supposed to See

The narrative pushed by asset seizure advocates is simple: billionaires bad, tax them. But look closer and you’ll see who actually benefits from current loopholes—and it’s not the founders building companies in garages.

Archived tweetAsset Seizure Tax vs Buy/Borrow/Die is the real class war: inherited rich vs built rich. Inherited wealth virtue signals luxury beliefs while waging war on productive people who build new things from nothing—from across all strata of society. The heirs want to seize your assets. Buy/Borrow/Die? It closes obvious loopholes for wealthy heirs who float through nonprofits, NGOs, and politics—never building anything. [Quoting @emre_mayo]: @garrytan Can just change inherited assets from stepped up basis to zero basis instead But middle aged progressives wouldn't like that. They are relying on that inheritance to support their lifestyle.

Garry Tan @garrytan January 29, 2026

The buy/borrow/die strategy is the actual playbook of inherited wealth. Heirs borrow against appreciated assets, live off the loans, never sell, and when they die the assets pass to the next generation with a stepped-up cost basis. All those gains? Never taxed. Meanwhile, the children of these heirs float through nonprofits, NGOs, and politics—never building anything productive—while virtue signaling about “the rich.”

Here’s the kicker: middle-aged progressives pushing wealth taxes often rely on their own coming inheritances. As one commenter noted, you could simply change inherited assets from stepped-up basis to zero basis—that would actually target inherited wealth. But progressives won’t support that. Why? Because they’re counting on that inheritance to support their lifestyle.

The Self-Made Myth Is Actually Real

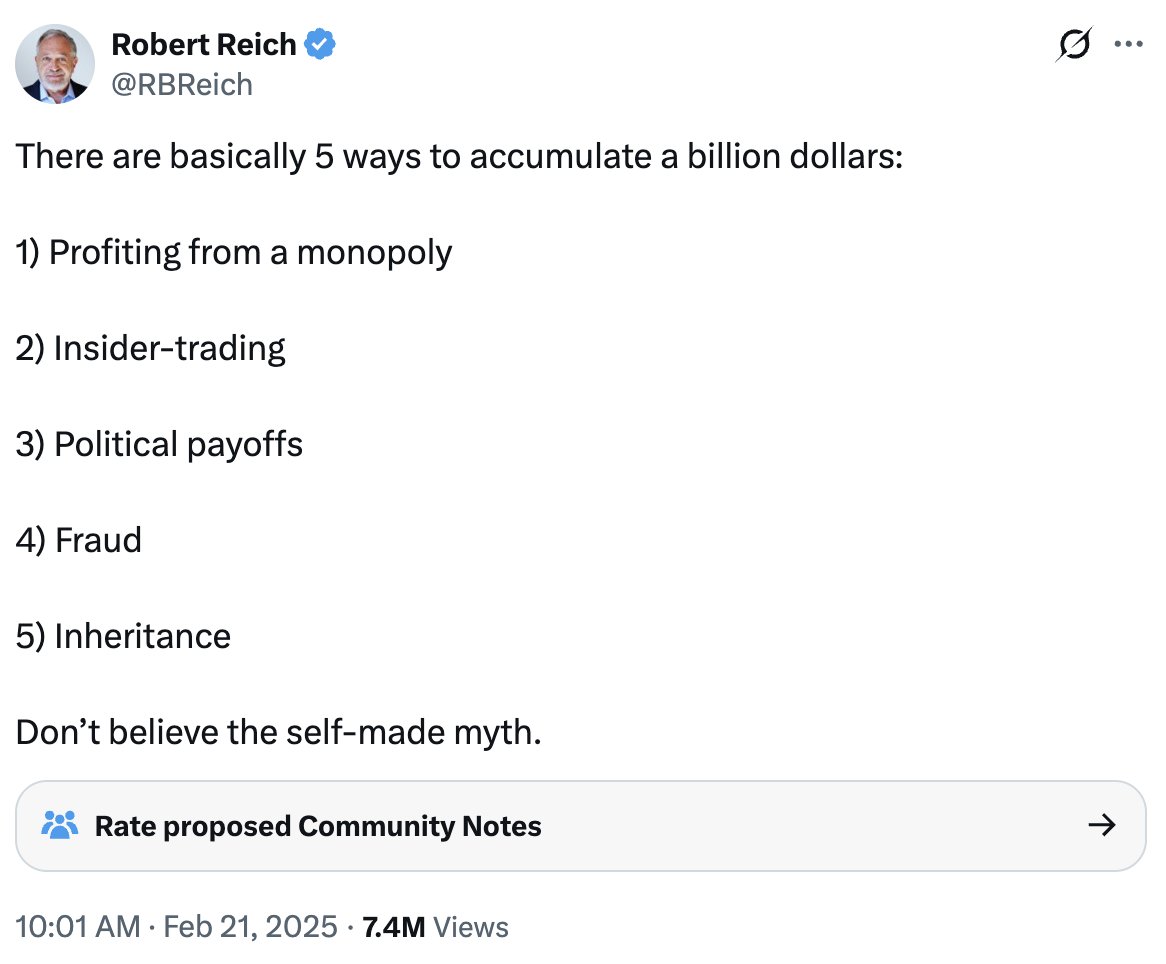

Robert Reich claims there are only five ways to accumulate a billion dollars: monopoly, insider trading, political payoffs, fraud, or inheritance. “Don’t believe the self-made myth,” he says. But Heritage Foundation research demolishes this narrative with data.

Archived tweetIn reality, the majority of wealth comes from self-made people building businesses that solve problems for the people around them. https://t.co/142xbxok0Q https://t.co/8NOkWJSKRK

Garry Tan @garrytan January 29, 2026

The numbers are stark: the median billionaire holds 89% of their net worth in companies they built—not inherited cash sitting in trusts. And here’s what happened to inherited wealth: of the Forbes 400 heirs from 2005, less than half remain on the list today. Those who stayed were three times more likely to fall in rankings than rise.

America had about 5 million new business formations between 2005 and 2020—but only 735 billionaires. Most entrepreneurs fail. The few who succeed create massive value for everyone: jobs, products, investment opportunities. Every dollar a billionaire makes from their company means seven or more dollars accruing to other investors, including retirement accounts.

There’s a Better Way to Close the Loophole

The buy/borrow/die loophole is real and should be fixed. But the solution isn’t wholesale asset seizure—it’s targeted reform that actually addresses the problem.

Archived tweetThey say that "self made" can't happen. They talk about closing tax loopholes. But they don't want to stop the tax loophole their parents took advantage of. They want to stop people from being self made entirely, and they don't want anyone to even try. https://t.co/QDXsYKvrRJ

Garry Tan @garrytan January 29, 2026

Reich’s hypocrisy runs deep: he rails against “self-made myths” while never acknowledging that his own proposals protect the exact loophole his generation’s heirs exploit. Bill Ackman and Yale law professor Zachary Liscow have proposed a smarter fix: tax borrowing against unrealized gains like capital gains, but allow deductions when assets are eventually sold. This prevents double taxation while eliminating the buy/borrow/die strategy entirely.

Even UC Berkeley law professor Chris Elmendorf supports this as a more sensible alternative to the ballot measure. This approach targets the actual loophole wealthy heirs use without forcing founders to liquidate ownership just to pay taxes on paper gains they’ve never realized.

Who Really Pays When Builders Leave

California’s top 1% pay 46% of state taxes. The top 5% pay 66%. When you threaten these people with asset seizure, they leave. And the data shows they’re already leaving—California loses roughly $1.4 billion per year in personal income tax revenue to out-migration. That rate has tripled compared to pre-pandemic levels.

Pirate Wires documented 21 billionaires planning to leave over the asset seizure proposal. When the tax base flees, remaining residents bear the burden through higher taxes and worse services. The lawyers and academics who wrote the asset seizure tax may actually want to destroy the tax base—some critics argue that for most wealth tax proponents, preventing the financial success of founders is the primary intent, not an unintended consequence.

The Wealthy NIMBYs Behind the ‘Anti-Wealth’ Movement

Robert Reich is a 79-year-old millionaire Berkeley professor who blocks housing development in his own affluent neighborhood while lecturing others about inequality. Pirate Wires exposes him as “essentially a hired gun on behalf of the unions and academics who crafted the asset seizure proposition.”

These people say self-made can’t happen. They talk about closing tax loopholes. But they don’t want to close the loophole their parents took advantage of. They want to stop people from being self-made entirely—and they don’t want anyone to even try.

The real fight isn’t about taxing the rich. It’s about whether California will let people build things. Support alternatives that close actual loopholes like buy/borrow/die while protecting builders. Oppose asset seizure taxes that punish creation while leaving inherited wealth untouched.

Follow @garrytan for more.

Related Links

-

Heritage Foundation: The Wealth of Billionaires (Heritage Foundation)

-

Garry Tan on the real class war (@garrytan)

-

Pirate Wires: California billionaire exodus (Pirate Wires)

-

Liscow/Ackman alternative to wealth tax (@ArmandDoma)

-

California tax revenue out-migration data (@kimmaicutler)

Comments (0)

Sign in to join the conversation.