The Golden Exit: $2.5 Trillion Fleeing California

Private polls show 80-90% of billionaires already gone or leaving. This isn’t about the rich—it’s about California’s survival.

Source: x.com

Source: x.com

TL;DR

California’s proposed wealth tax is triggering the largest wealth flight in American history, with $2-2.5 trillion in assets leaving and the state’s entire fiscal foundation at risk of collapse.

David Friedberg’s viral thread captures the staggering scale of what may be the largest wealth flight in California history. Private polls show 80-90% of affected billionaires have already left or will leave if the ballot measure passes. We’re watching a state commit economic suicide in real time.

Archived tweetStop the Golden Exit Destroying innovation in California will impoverish everyone in the state https://t.co/luPMyatcPT https://t.co/3EWih7YHsQ [Quoting @friedberg]: California started with the Gold Rush and might end with the Golden Exit. it has been underreported how much wealth has left CA because of the asset seizure tax being proposed. a private poll was conducted amongst affected individuals a few days ago and 80-90% surveyed said they have already left CA in 2025 or will leave in 2026 if the ballot measure looks likely to pass. $2-2.5T of assets gone, representing about $20B of annual revenue for the state government. and likely hundreds of thousands of jobs now at risk. less reported is the bigger exodus underway from folks who are NOT directly affected but worry (as they should) that this law will quickly transition from billionaires to everyone else... the initiative actually gives CA legislators the right to take anyone's post-tax assets anytime in the future based on a majority vote. this isn't about billionaires. it's a new "tax system" that simply destroys private property rights in America. all private property is now public property. even after paying your taxes, it's not legally your property anymore. it's the government's, you're just borrowing it. legislators will decide what you get to keep and temporarily use each year. countless founders, CEOs, and other business leaders are actively looking to move their companies out of state. not just tech, not just AI, not just billionaires, but the core engine of California's prosperity since 1847 is unraveling. and here is how this initiative risks unraveling America: - ~10 states have explicit or implicit prohibitions against an asset seizure tax... - individuals affected in CA (and other states trying to do the same) will move to these states that endow private property rights. - CA already has a $20-30B annual budget deficit, an unfunded ~$1T pension liability for public employees/unions, and $500B of debt outstanding. the state can not afford to borrow much more and will launch more asset seizures to meet its obligations. - asset seizures will first transition to "millionaires" and eventually to the entire middle class as more asset seizures drive more people to leave the state. - the deficit, debt, and job loss will spiral. the Golden Exit. - no US state has ever declared bankruptcy. in addition to CA, dozens of other states face similar fiscal crises - legislators promised future benefits that can't be paid or theft and waste have been allowed to run rampant and unabated for years. - struggling states will eventually request federal government assistance, as they always have in times of fiscal crisis, effectively "federalizing state debt". - states not in crisis will declare "enough is enough", individuals in those states will refuse to pay their federal taxes (why pay for other people's mistakes?), some states may try to secede from the Union, and a constitutional and civil crisis will erupt. this may seem far-fetched but it is the obvious domino effect of selectively deleting private property rights for some people in some states. i am not a billionaire and this CA bill does not affect me, but i care about the country and the state of CA. i want both to thrive. it's obvious that there are people in CA in desperate need of support and assistance, and inequities may exist that need to be rectified, but eliminating private property rights is the wrong path for everyone. a few alternatives to consider first: 1) with a $350B annual budget, CA can cut programs that result in theft and little-to-no benefit for citizens. $50B per year is likely recoverable. 2) if more taxes are needed, tax loans against unrealized capital gains (very few objections will arise), eliminate tax-free rollover of certain appreciated assets (real estate industry will fight), create a step up in basis on inheritance (some will fight but most will support). likely $10Bs of incremental revenue can be realized. 3) restructure all public retirement programs from Defined Benefit to Defined Contribution. eliminating the unfunded retirement liabilities ($1T+) will be the release valve on the future the state so desperately needs. we must address what ails us without dividing and destroying our state, our nation, our home. ignore the rhetoric, these are the facts.

Garry Tan @garrytan January 15, 2026

The warning couldn’t be clearer: destroying innovation in California will impoverish everyone in the state. But the ballot measure’s backers either don’t understand this or don’t care.

The Numbers Are Catastrophic

The scale of the exodus is unprecedented. According to Friedberg’s analysis, a private poll conducted among affected individuals shows 80-90% have already left California in 2025 or will leave in 2026 if the ballot measure looks likely to pass. This isn’t speculation—it’s happening right now.

Pirate Wires surveyed the largest billionaire Signal chat and found 70% confirmed they’ll leave. Mike Solana interviewed 21 billionaires—roughly 10% of the state’s total—and every single one is planning to exit.

The fiscal impact is staggering: $2-2.5 trillion in assets leaving, representing approximately $20 billion in lost annual state revenue. And here’s what makes this truly devastating—the top 1% of Californians pay 46% of state taxes. The top 5% pay 66% combined. When they leave, who pays? Everyone else.

It’s Not Just About Billionaires

This is where it gets worse. Codie Sanchez reports that almost every serious founder she’s talked to in California has concluded they’ll have to leave as their primary residence eventually. The exodus is spreading far beyond the billionaire class.

The initiative actually gives California legislators the right to take anyone’s post-tax assets anytime in the future based on a majority vote. This isn’t about billionaires—it’s a new “tax system” that simply destroys private property rights in America.

Remember history: the federal income tax started as only applying to ~1% of earners. Now look where we are. Fear that wealth taxes will follow the same expansion path—from billionaires to millionaires to the middle class—isn’t paranoia. It’s pattern recognition.

UC Berkeley economist Enrico Moretti, according to the SF Standard, expects founders will start companies in other states if the proposal passes: “Other examples of wealth taxation tell us that in the end, people relocate. I don’t expect that we will lose every single billionaire, but I think the losses will exceed the benefits.”

California’s Fiscal Time Bomb

California already has a $20-30 billion annual budget deficit, roughly $1 trillion in unfunded pension liability for public employees and unions, and $500 billion of debt outstanding. The state cannot afford to borrow much more—and now it’s about to lose its tax base.

The domino effect is obvious: asset seizures first transition to “millionaires” and eventually to the entire middle class as more asset seizures drive more people to leave the state. The deficit, debt, and job loss spiral. No US state has ever declared bankruptcy, but California might force federal intervention—creating a constitutional crisis as states not in crisis refuse to federalize other states’ reckless debt.

The Alternative Path Forward

Friedberg outlines sensible alternatives that don’t require destroying property rights:

Cut wasteful programs: With a $350 billion annual budget, approximately $50 billion per year is recoverable from programs resulting in theft and little-to-no benefit for citizens.

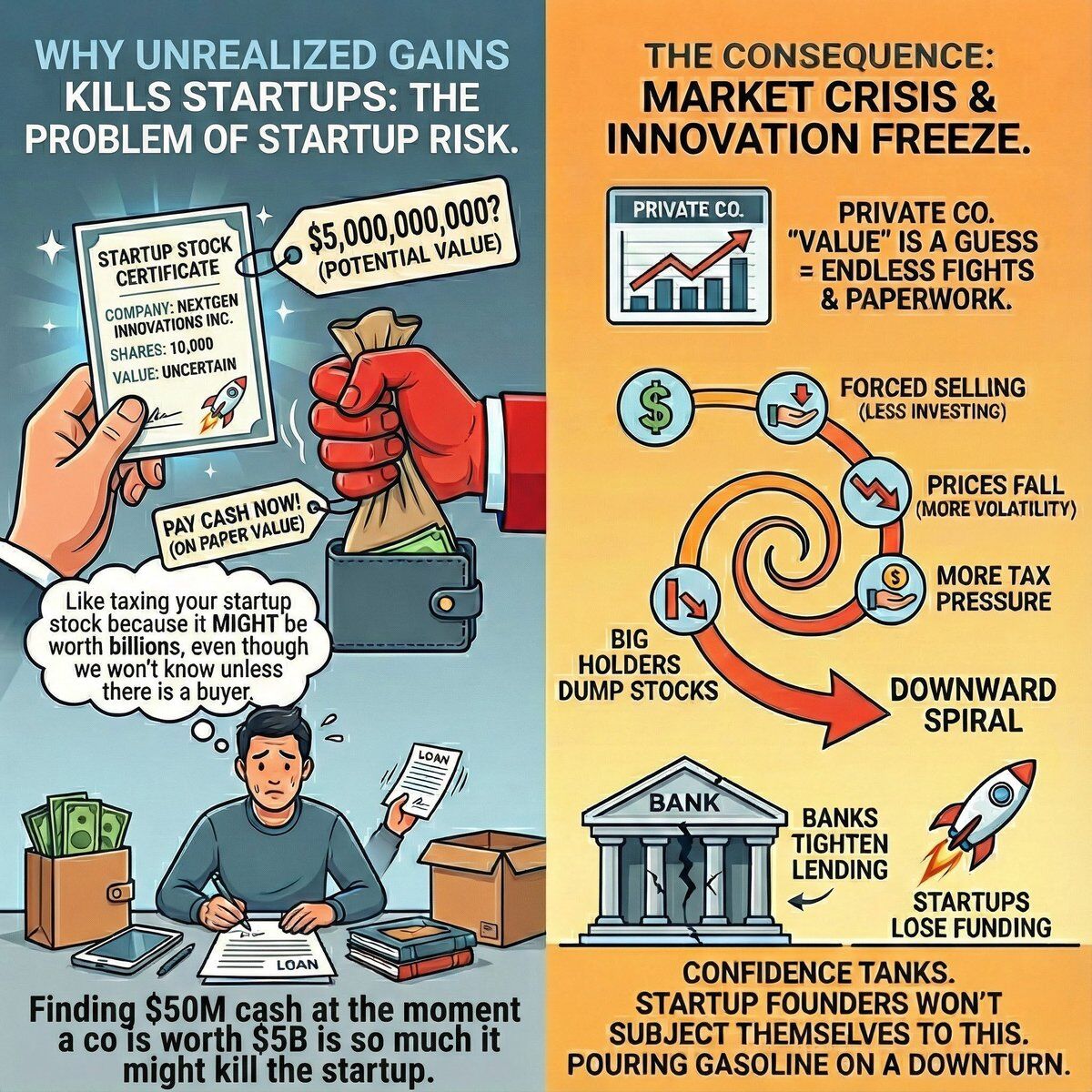

Tax loans against unrealized capital gains instead of the gains themselves—very few objections will arise.

Eliminate tax-free rollover of appreciated assets, especially in real estate.

Create a step-up in basis on inheritance—some will fight, but most will support it.

Restructure public retirement programs from Defined Benefit to Defined Contribution—eliminating the $1 trillion+ unfunded liabilities that are the real fiscal time bomb.

The wealth tax battle isn’t about making billionaires pay their “fair share"—it’s about whether California remains a place where startups can be built, where innovation is rewarded, and where property rights mean something. With the ballot measure heading to voters, the outcome will determine whether Silicon Valley’s next generation stays or follows the current exodus to Texas, Florida, and beyond.

We can address what ails us without dividing and destroying our state. But first, we have to actually understand what’s at stake.

Follow @garrytan for more.

Related Links

-

Friedberg's viral thread on the Golden Exit (@friedberg)

-

Pirate Wires: Exodus - The Largest Wealth Flight (Pirate Wires)

-

SF Standard: Billionaire Tax Backlash Spreading (SF Standard)

-

Codie Sanchez on founder exodus (@Codie_Sanchez)

Comments (0)

Sign in to join the conversation.