Startup Exits Double Every Five Years

Hard data proves the abundance machine is accelerating—while pessimists run scarcity scripts from an obsolete world.

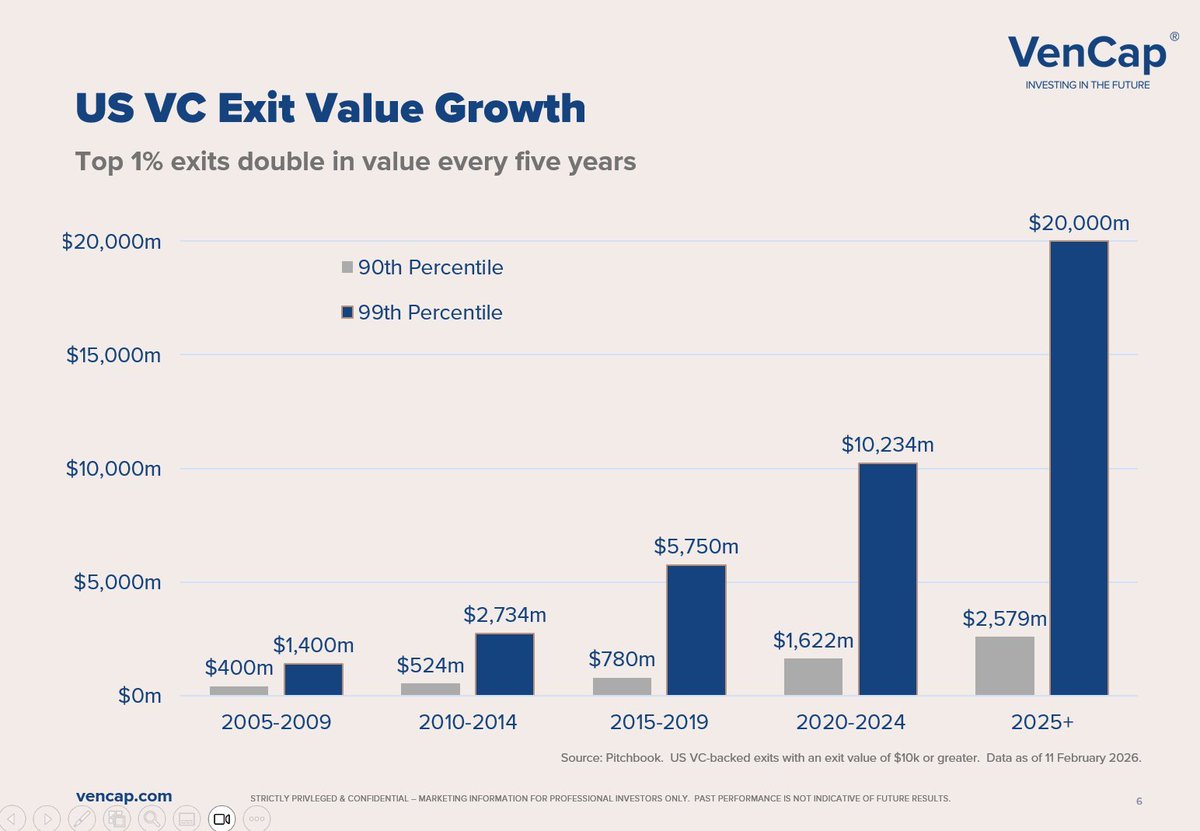

The numbers tell the story: top 1% exits double every five years. This isn't speculation—it's VenCap data showing two decades of compounding abundance. Chart: @yuris tweet / VenCap

Source: x.com

The numbers tell the story: top 1% exits double every five years. This isn't speculation—it's VenCap data showing two decades of compounding abundance. Chart: @yuris tweet / VenCap

Source: x.com

TL;DR

Top 1% startup exits have grown from $1.4B to $20B projected over 20 years. This is what an ascending market looks like—more technology, more jobs, faster growth.

This is what an ascending market looks like. More technology made by more people, faster. If you create jobs and abundance at a time where technology raises the expectations for standard of living and what humans are capable of, this is what you get.

The numbers are staggering. The top 1% of venture-backed exits are doubling in value every five years—not a one-time spike, but a consistent pattern across two decades of data.

The Data: Exits Are 10x What They Were

VenCap’s data shows the 99th percentile exits went from $1.4 billion in 2005-2009 to a projected $20 billion for 2025 and beyond. The 90th percentile? From $524 million to $5.75 billion over the same period. That’s roughly 10x growth in outcomes for the best startups.

Yuri Sagalov, who’s been both a founder and investor, captures what this means in practice: seed valuations rose from around $4 million to $20 million because actual outcomes exceeded expectations. VCs wanted $1B outcomes, but the reality proved to be closer to $5B. Now the outcomes look even bigger.

This isn’t speculation. It’s pattern recognition backed by Pitchbook data spanning two decades. The top founders aren’t just doing a little better—they’re operating on an entirely different scale than the previous generation.

Why This Is Happening: Technology Creates Abundance

The obvious answer is AI. About 80% of Y Combinator’s current batch is AI-focused, and it’s the fastest-growing cohort in YC’s history. These companies are hitting commercial traction earlier than anything we’ve seen before.

But the shift is bigger than any single technology wave. We’re seeing the transition from allocation to creation. Small teams—sometimes just an engineer who couldn’t get a job at Meta or Google—can now build standalone businesses making $10 million or $100 million a year with ten people. That’s an entirely new category of outcome that didn’t exist a decade ago.

The exponential improvement in what technology can do means the pie keeps expanding. More founders, more experiments, more outcomes. The compounding effect creates abundance that the scarcity-minded simply cannot comprehend.

Most people are still running scarcity scripts from a world that’s already obsolete. They see exponential technology and panic. They see threat instead of possibility. But the data tells a different story: builders are creating more value, faster, for more people than ever before.

This is what abundance looks like in real numbers. While some politicians run scarcity scripts from an obsolete world, builders are creating jobs, raising standards of living, and proving that technology actually delivers. The question isn’t whether this continues—it’s whether you’re building or blocking.

Take Action

Share this with someone who still thinks tech is zero-sum

Related Links

-

Garry Tan on the ascending market (@garrytan)

Comments (0)

Sign in to join the conversation.