SF Is Winning the AI Race. Politicians Want to Kill It.

San Francisco is the only tech hub in America with growing startup formation—and city hall is doing everything it can to drive companies out.

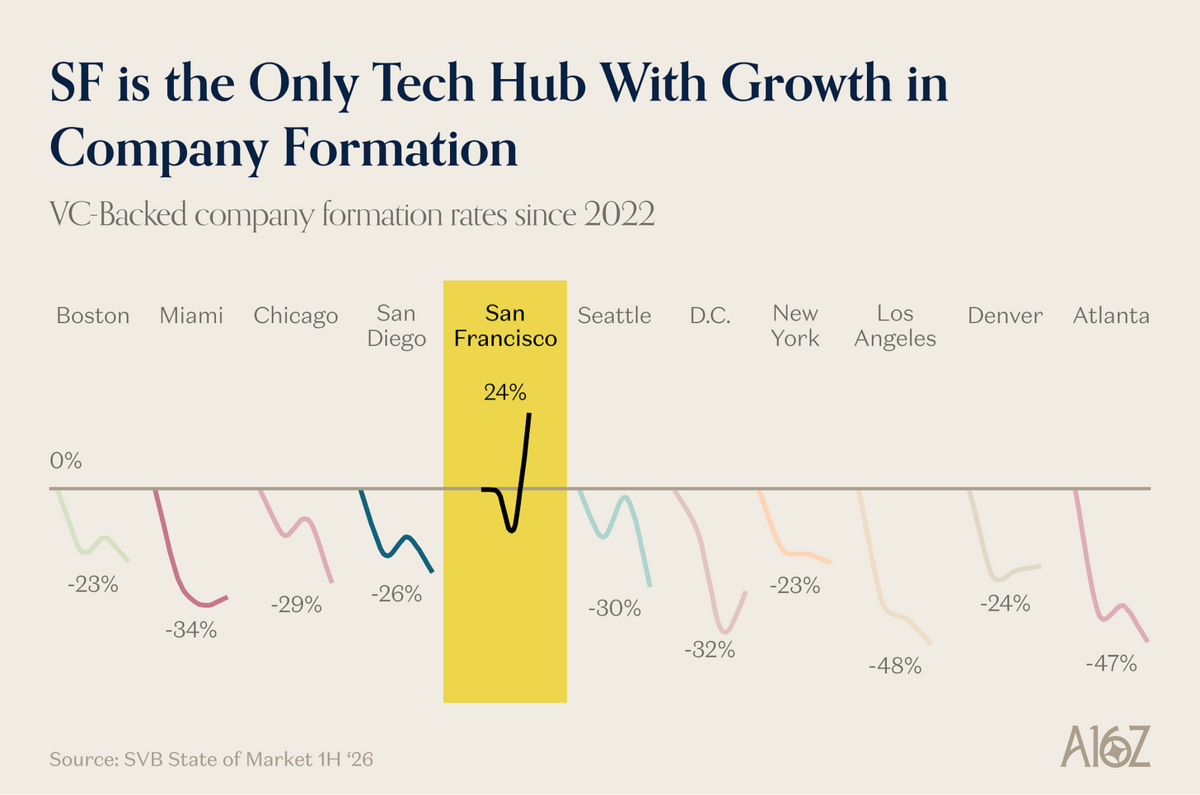

The chart says it all: San Francisco is the only tech hub in America with growing startup formation. Every other city is in decline. This is what we're fighting to protect. Chart: a16z/SVB State of Market 1H '26

Source: a16z.news

The chart says it all: San Francisco is the only tech hub in America with growing startup formation. Every other city is in decline. This is what we're fighting to protect. Chart: a16z/SVB State of Market 1H '26

Source: a16z.news

TL;DR

SF is the ONLY VC hub with positive company formation growth (+24%) while every other city declines—but an 800% gross receipts tax hike and lab bans threaten to destroy what makes the city special.

San Francisco is the only tech hub in America with growing startup formation. And San Francisco politicians are doing everything they can to kill it.

Archived tweetSan Francisco is important for American tech innovation With the 800% additional gross receipts tax (Supported by Bilal Mahmoud who was supposed to help tech but isn’t) and the Mission District laboratory ban that almost passed… we have to work harder to protect SF tech https://t.co/gAv4UZoLsw [Quoting @a16z]: SF is back. Charts of the Week: https://t.co/TJgEoHRMdd https://t.co/WbvSxNQurt

Garry Tan @garrytan February 14, 2026

The data is unambiguous. While Boston (-34%), NYC (-32%), LA (-48%), and even Austin (-47%) have seen VC-backed company formation collapse since 2022, San Francisco is up 24%. We’re not just holding on—we’re the only city actually growing.

The Data: SF is Winning the AI Race

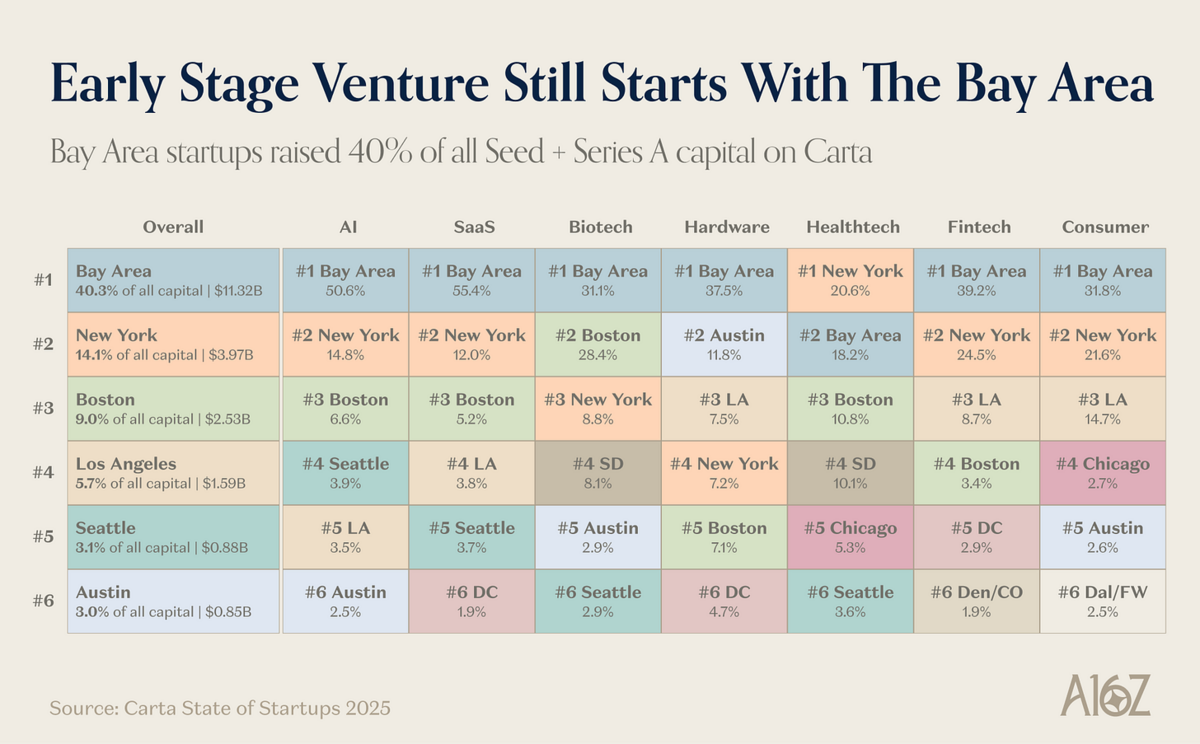

According to a16z’s latest analysis, San Francisco is the only VC hub experiencing an increase in company formation since 2022. Every other major tech hub is deeply in the red. The Bay Area captures roughly 40% of all early-stage venture dollars and ranks #1 in every vertical except Healthtech. This isn’t a fluke—it’s the AI boom playing out exactly where it should.

Big Tech capex is projected to hit $650 billion in 2026—triple what it was in 2024. That’s the AI infrastructure buildout, and it’s happening here. And history tells us this isn’t a job-killer—it’s a job-creator. The a16z data shows that over half of net-new jobs since 1940 are in occupations that didn’t exist in 1940. AI will be no different. SF needs to be where those new jobs are created.

The 800% Tax Hike They’re Calling a ‘CEO Tax’

Here’s the con: The so-called “CEO Tax” doesn’t tax CEOs. It’s a gross receipts tax increase—up to nearly 800% on the Administrative Office Tax—disguised with populist branding. GrowSF reports that companies with CEO-to-worker pay ratios over 100x see their rates climb to nearly 9x current levels. The tax is charged on total revenue, not profit. Low-margin businesses like grocery stores and pharmacies get hammered hardest—and those costs get passed directly to consumers.

We’ve been here before. In 2018, Prop C created a gross receipts tax that counted all money flowing through a company as revenue. Pirate Wires documented what happened next: Stripe moved its headquarters 10 miles to South San Francisco. Several companies dissolved their HQs altogether. SF learned nothing.

A startup with 250 employees and $750 million in gross receipts (NOT PROFIT) would pay $10.4 million annually in San Francisco, compared to $4 million in Oakland, $17,000 in San Jose, and $3,600 in Sunnyvale. That’s a 600x difference between SF and Sunnyvale for the same company. Right at the moment startups are taking off, SF is telling them to leave.

Bilal Mahmood’s Betrayal

Bilal Mahmood ran as the pro-tech, pro-housing moderate in District 5. The tech community showed up for his campaign expecting him to protect innovation. Then he voted FOR the 800% gross receipts tax increase.

GrowSF put it plainly: they’re “particularly disappointed” to see Mahmood supporting this tax, which will impact residents of his district the hardest. People who use SNAP benefits to buy groceries will see their food costs rise. Meanwhile, every “overpaid CEO” living in his district will see no impact whatsoever on their personal finances. The “CEO Tax” doesn’t tax CEOs—it taxes consumers. Mahmood was supposed to help tech but isn’t.

The Lab Ban That Almost Was

Late last year, socialist SF Supervisor Jackie Fielder tried to sneak in a ban on all R&D via city zoning laws—including AI research and cancer research in the Mission. They would set up a special approval procedure run by Fielder that would give her cronies the ability to extract anything they want from new R&D labs.

Fielder’s team vehemently argued it wasn’t a ban. But moving from “allowed” to “requires conditional use approval” IS a ban in practice. When every lab needs political permission to exist, politics decides which labs exist. Cancer research. Climate tech. Life sciences. AI. All of it would need Fielder’s blessing.

It was gutted by more reasonable voices—but it got dangerously close to passing. That’s how fragile innovation’s future in SF really is.

SF is winning the startup race despite its politicians, not because of them. The data proves it: this is the only city in America where startup formation is growing. But that lead is fragile. Every 800% tax hike, every lab ban attempt, every betrayal by supposed allies chips away at what makes this city special. We have to work harder to protect SF tech—because SF tech is American tech innovation.

Related Links

-

CEO Tax Doesn't Tax CEOs (GrowSF)

-

Another Day, Another Suicidal San Francisco Ballot Prop (Pirate Wires)

-

Garry Tan on SF gross receipts tax comparison (@garrytan)

-

Garry Tan on Jackie Fielder's lab ban (@garrytan)

Comments (0)

Sign in to join the conversation.