Ro Khanna’s 96% Problem

When nearly all your campaign cash comes from outside your district, who are you really representing?

The organizing has begun. Many who supported Ro when he needed them early on now see him abandoning his district for presidential ambitions and pushing policies that destroy prosperity. If you're one of them, this is your moment to be counted. Image: @garrytan tweet

Source: x.com

The organizing has begun. Many who supported Ro when he needed them early on now see him abandoning his district for presidential ambitions and pushing policies that destroy prosperity. If you're one of them, this is your moment to be counted. Image: @garrytan tweet

Source: x.com

TL;DR

Congressman Ro Khanna is pushing a federal wealth tax that failed everywhere it’s been tried—while 96% of his campaign funds come from outside Silicon Valley. CA-17 residents are organizing to primary him.

When 96% of your campaign funds come from outside your district, who are you really representing? Congressman Ro Khanna’s push for a federal wealth tax reveals whose interests really matter to him.

A Congressman Who Answers to Someone Else

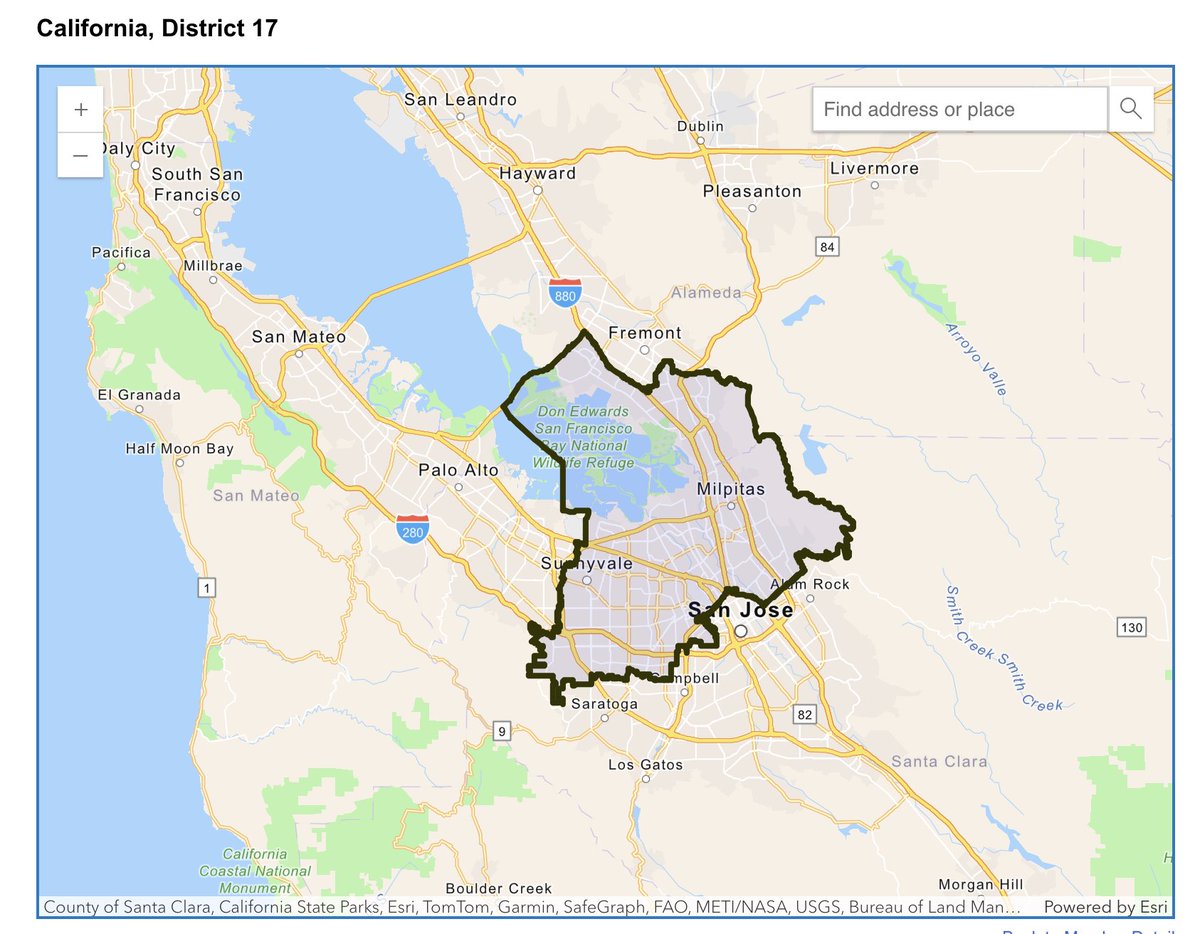

The numbers don’t lie. According to campaign finance data, 94-96% of Ro Khanna’s contributions came from outside his district. Only 5% of funding came from within CA-17, while over $9M poured in from out of district.

This is personal for me. I grew up in Fremont—in this district. I learned to code there. My parents bought their first home there. CA-17 is 56% Asian American immigrants who came here for the American Dream—economic mobility, not wealth destruction. A representative of Silicon Valley should represent Silicon Valley values. Instead, Khanna has become a hard leftist congressman, abandoning the constituents who he’s supposed to represent in favor of a national profile.

The Federal Wealth Tax Push

Archived tweetCongressman Ro Khanna is demanding a federal unrealized gains tax and mass seizure of post-tax assets at the FEDERAL level. The wealth taxes in Europe made people poorer, and that's why so few remain! They've jumped to destroying prosperity not just in CA, but all of America. https://t.co/0OZJTMgXoi

Garry Tan @garrytan January 15, 2026

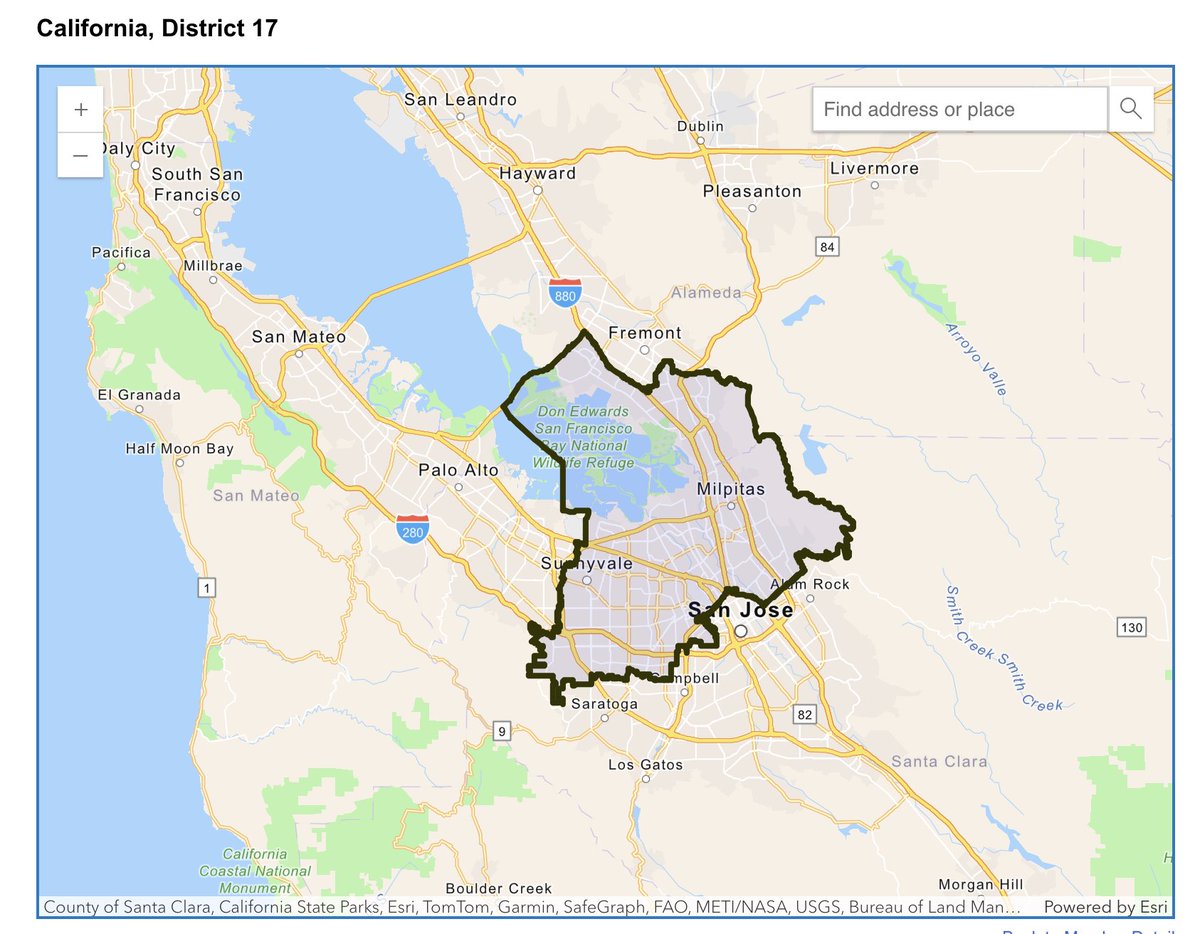

Khanna isn’t just supporting California’s wealth tax disaster—he’s demanding we take it national. He wants a federal unrealized gains tax and what amounts to mass seizure of post-tax assets at the federal level. In his own words from a recent interview, he explicitly said he supports doing it at the federal level because “it would be easier to administer.”

He even admitted there’s a constitutional challenge—and he supports it anyway. The “Billionaire Tax” framing is a lie. These unrealized gains taxes don’t just hit people with Scrooge McDuck money vaults. They hit startup founders whose wealth is paper equity in companies they’re building. This is about destroying prosperity not just in California, but all of America.

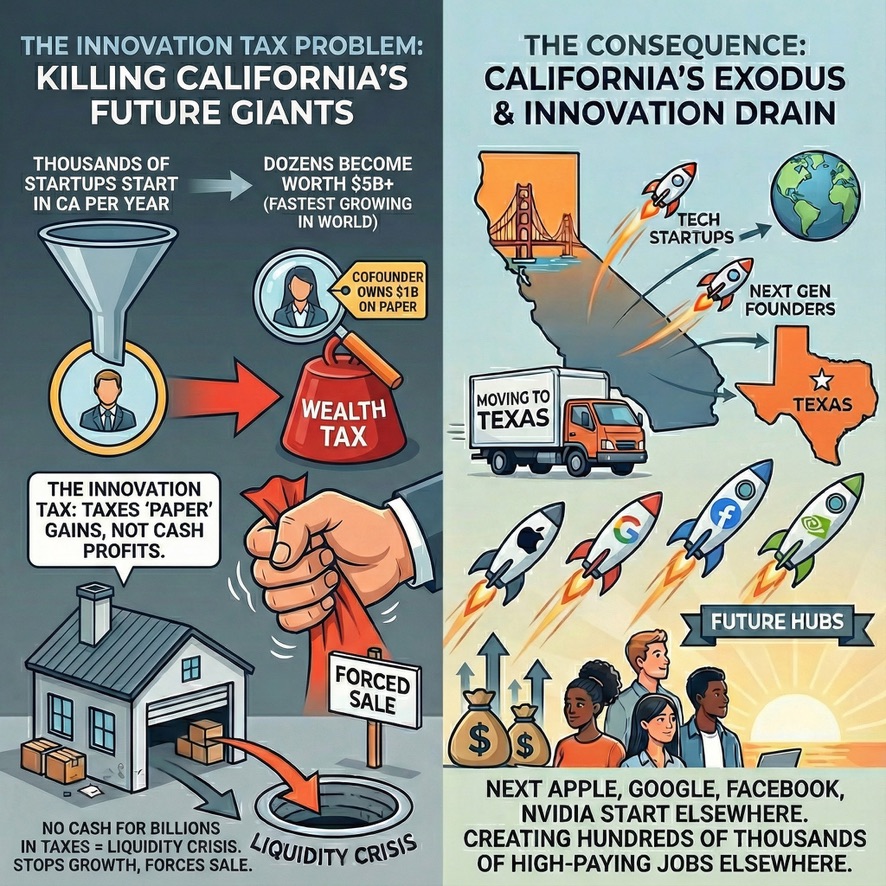

Europe Already Tried This—It Failed

The wealth tax experiment has already been run. Twelve European countries tried wealth taxes, only three still have them. When Europe implemented these in the 1990s, employment dropped 33% and tax payments dropped 51%. The wealth taxes made people poorer—that’s why most countries abandoned them.

Why would we repeat failed European experiments? The answer is asset seizure taxes should be opposed everywhere. There are better ways to close tax loopholes—like a Buy/Borrow/Die tax—that don’t trigger mass capital flight.

The Exodus Is Already Happening

This isn’t theoretical. According to David Friedberg, a private poll showed 80-90% of affected wealthy individuals have already left California in 2025 or will leave in 2026 if the ballot measure looks likely to pass. That represents $2-2.5T of assets potentially gone—and roughly $20B in annual state revenue.

California already loses about 1.6% of personal income tax revenue per year to out-migration—around $1.4B annually. And here’s the kicker: the top 1% pay 46% of California taxes. Lose them, and you devastate the tax base that funds schools, roads, and services for everyone.

Friedberg put it best: California started with the Gold Rush and might end with the Golden Exit.

Representative Democracy Exists—Vote

Here’s the good news: we have elections.

Archived tweetSome friends of mine who are very upset at Ro Khanna are organizing. When 96% of your campaign funds come out of district, it's obvious that your loyalties start to lie outside of your district too. But that's why representative democracy exists. Vote. https://t.co/hUpXfHELi7 https://t.co/XFDFDvA9gu https://t.co/Z6emQoVdEJ [Quoting @garrytan]: Congressman Ro Khanna is demanding a federal unrealized gains tax and mass seizure of post-tax assets at the FEDERAL level. The wealth taxes in Europe made people poorer, and that's why so few remain! They've jumped to destroying prosperity not just in CA, but all of America. https://t.co/0OZJTMgXoi

Garry Tan @garrytan January 26, 2026

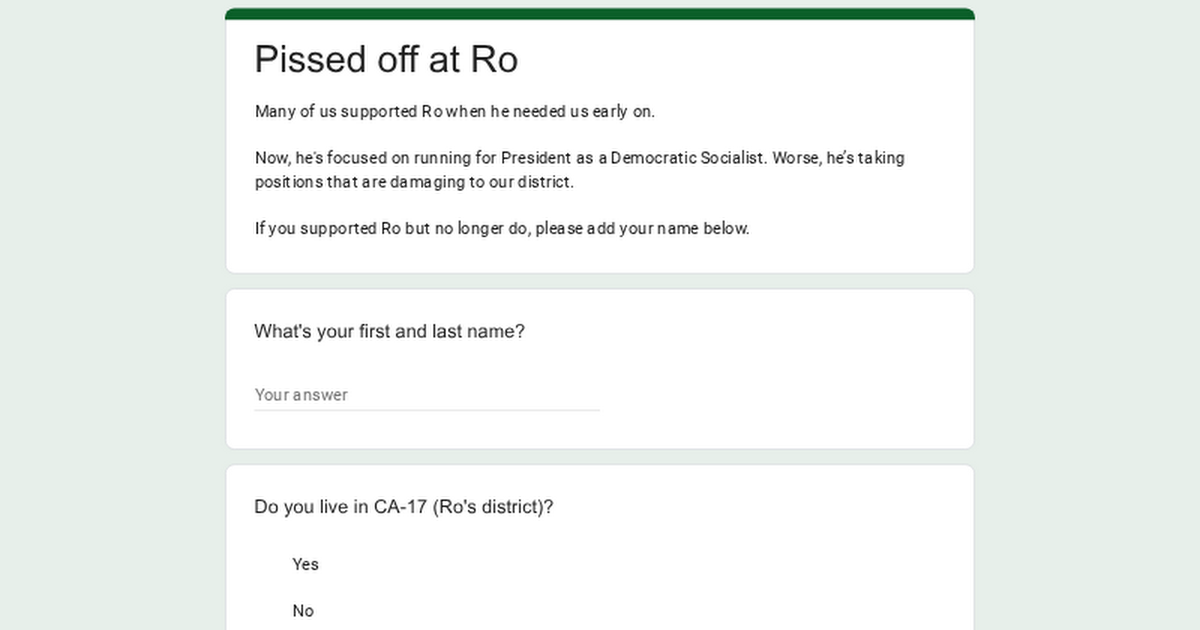

Friends of mine who are very upset at Ro Khanna have started organizing. The “Pissed off at Ro” campaign is collecting names of former supporters who have withdrawn their support. The June 2026 primary is the target. There’s time to find someone better—someone who actually represents the people of Silicon Valley.

Ro Khanna has made his choice. He’s running for President, not representing CA-17. His push for federal wealth taxes that have failed everywhere they’ve been tried shows he’s more interested in national leftist credentials than in the people who elected him. But that’s why we have elections. If you’re in CA-17 and you’ve had enough, sign up and make your voice heard.

Follow @garrytan for more.

Related Links

-

Pissed off at Ro - Sign the petition (Google Forms)

-

Ro Khanna - District Map (Congress.gov)

-

Garry Tan on Khanna's out-of-district funding (@garrytan)

-

David Friedberg on California capital flight (@friedberg)

Comments (0)

Sign in to join the conversation.