California Taxes Affordable Housing Into Oblivion

Cities skim $300 million a year in fees from affordable housing projects, then wonder why we can’t house families.

The impact of fees against affordable and market rate housing is much much more costly than the paltry revenue taken in by California and local jurisdictions with impact fees.

The impact of fees against affordable and market rate housing is much much more costly than the paltry revenue taken in by California and local jurisdictions with impact fees.

TL;DR

California cities charged affordable housing projects $1.2 billion in impact fees from 2020-2023—enough to build 5,000 more homes for low-income families.

Think of each new affordable apartment like a school desk for a low-income kid. We’re charging massive upfront “desk fees” with our tax system—for 134 projects, cities took over $30,000 per apartment in impact fees. Instead of using tax dollars to build more affordable homes, we’re taxing affordable homes themselves, skimming tens of thousands off each unit in fees and then wondering why we can’t afford enough housing.

Archived tweetFrom 2020–2023, cities charged affordable housing projects about $300 million a year in extra fees. If those fees were lower, that money could instead build about 1,250 more affordable homes every year, because each new home needs around $200,000 in subsidy to pencil. https://t.co/4Lrni5xp3T https://t.co/FbphCvJbph [Quoting @MattMahanSJ]: Spot on from @mnolangray: “Impact fees should be rooted in actual fiscal impacts." When San Jose lowered fees, we unlocked thousands of new homes. We need to do this statewide. https://t.co/4rtbxdBllb

Garry Tan @garrytan February 10, 2026

The $1.2 Billion Grift

A new UC Berkeley Terner Center study exposes the scale of this bureaucratic extraction: from 2020-2023, California cities collected $1.2 billion in development impact fees from affordable housing projects. That’s $300 million a year—money that could have funded 1,250 additional affordable homes annually at $200,000 subsidy per unit. The math is devastating: 5,000 homes for low-income Californians blocked in just four years by government fees on government-subsidized housing.

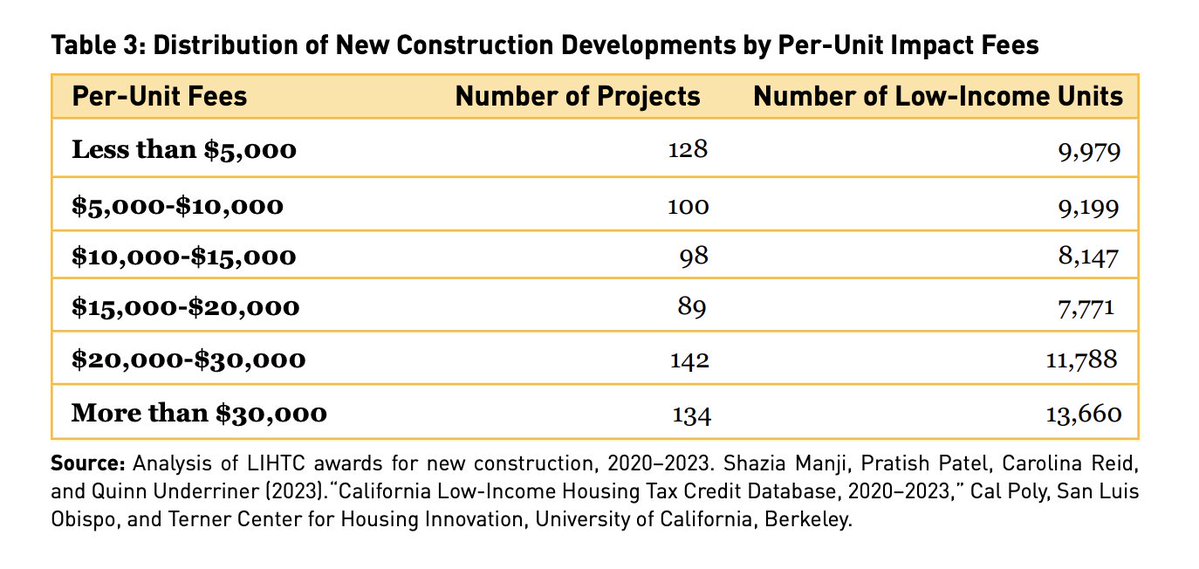

The average fee was $19,806 per unit, but 134 projects paid over $30,000 per unit. As the Orange County Register editorial puts it: “Local fees prevented the building of 5,000 new homes for low-income Californians from 2020-23.”

Taxing Poverty to Fund Parks

Here’s what makes this truly absurd: parks and recreation fees make up 35% of total impact fees—the single largest category. Some projects faced parks fees above $25,000 per unit alone. We’re literally funding park upgrades by making affordable housing unaffordable.

Family housing gets hit hardest: $24,054 per unit versus $13,810 for special needs housing. So the families with children who need the most space pay the highest fees. The Terner Center found that “parks and recreation fees and water and sewer charges generally comprised the largest share of fees assessed on a LIHTC project, comprising, on average, 35 percent of total fees.”

The Prop 13 Excuse Is a Lie

Cities love to blame Proposition 13 for needing high fees. It’s a convenient excuse. But according to Jon Coupal, president of the Howard Jarvis Taxpayers Association, California ranks 18th in per capita property tax collections. “California is not a low property tax state,” Coupal notes.

Sen. John Moorlach nails the irony: high fees reduce housing development, which reduces the property tax revenue cities would have collected anyway. And here’s the kicker—impact fees constitute only 1.1% of total city revenues on average. A rounding error for cities. Life-changing for the families who could have had homes.

San Jose Proves It Works

Mayor Matt Mahan lowered fees in San Jose and unlocked thousands of new homes. The results? San Jose broke ground on 2,000+ homes in 2025 after building zero market-rate homes the year before.

Archived tweetSpot on from @mnolangray: “Impact fees should be rooted in actual fiscal impacts." When San Jose lowered fees, we unlocked thousands of new homes. We need to do this statewide. https://t.co/4rtbxdBllb

Mayor Matt Mahan @MattMahanSJ February 10, 2026

Nolan Gray, senior director at California YIMBY, puts it bluntly: “Impact fees should be rooted in actual fiscal impacts… not just generate extra revenues for governments, which is how they are used today.” When Palo Alto waived fees, Mitchell Park Place saved $3.8 million—$76,000 per unit that went toward housing people instead of government coffers.

This Is Solvable

Only 61 of 691 projects received any fee relief—a pathetic $39.2 million total. We need statewide action, not city-by-city battles. The state should require fee waivers for affordable housing and offset local revenue losses with infrastructure grants.

Every year we wait is another 1,250 families without homes. You can build housing and make space for people and create prosperity for everyone, all at the same time. San Jose proved it. Now we need every city—and Sacramento—to follow.

Related Links

-

UC Berkeley Terner Center Study on LIHTC Impact Fees (Terner Center)

-

Editorial: California needs local housing fee reform (Orange County Register)

-

Mayor Matt Mahan on impact fees (@MattMahanSJ)

Comments (0)

Sign in to join the conversation.