California’s Wealth Tax Will Destroy Itself

Even Gavin Newsom admits taxing billionaires will backfire. Europe already proved it. Why won’t Sacramento listen?

Governor Newsom at the Bloomberg event in San Francisco where he warned that the proposed wealth tax will backfire—a rare moment of fiscal reality from Sacramento. Photo: Bloomberg.

Source: x.com

Governor Newsom at the Bloomberg event in San Francisco where he warned that the proposed wealth tax will backfire—a rare moment of fiscal reality from Sacramento. Photo: Bloomberg.

Source: x.com

TL;DR

Governor Newsom warns California’s proposed wealth tax will cause an exodus of the ultra-rich—exactly what happened when 12 European countries tried it and 9 abandoned ship.

Even Gavin Newsom is waving the white flag on California’s wealth tax experiment. When the state’s Democratic governor warns that taxing billionaires will backfire, maybe it’s time to listen.

Archived tweetCapital flies away when asset seizure taxes start happening Europe tried it in the 1990s and employment dropped 33% and tax payments dropped 51% https://t.co/t6ibjS40LX https://t.co/mJTyRZ9Oxh [Quoting @CityLab]: California Governor Gavin Newsom warned that a proposed one-time tax on billionaires will backfire by prompting the ultra-rich to leave the state https://t.co/9JBZU6QgJV

Garry Tan @garrytan January 30, 2026

Capital flies away when asset seizure taxes start happening. This isn’t theory—it’s documented history.

Europe Already Ran This Experiment

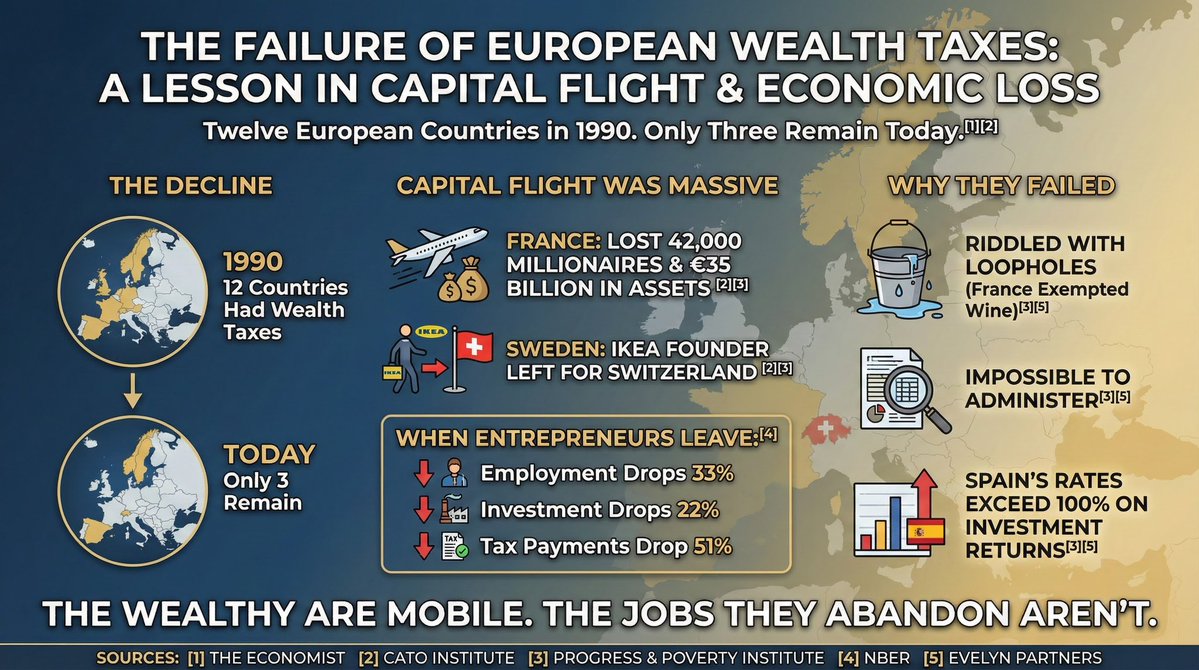

Twelve European countries had wealth taxes in 1990. Today, only three remain. Why? Because capital flight devastated their economies.

![THE FAILURE OF EUROPEAN WEALTH TAXES:

A LESSON IN CAPITAL FLIGHT & ECONOMIC LOSS

Twelve European Countries in 1990. Only Three Remain Today.[1][2]

THE DECLINE

1990

12 Countries

Had Wealth

Taxes

TODAY

Only 3

Remain

CAPITAL FLIGHT WAS MASSIVE

FRANCE: LOST 42,000

MILLIONAIRES & €35

BILLION IN ASSETS [2][3]

SWEDEN: IKEA FOUNDER

LEFT FOR SWITZERLAND [2][3]

WHEN ENTREPRENEURS LEAVE:[4]

Employment Drops 33%

Investment Drops 22%

Tax Payments Drop 51%

WHY THEY FAILED

RIDDLED WITH

LOOPHOLES

(Fran...](https://dm2nowkhw0ff4.cloudfront.net/content_media/481ed2b5-5637-41c5-bed1-d582990c79c1.jpg)

France lost 42,000 millionaires and €35 billion in assets. The IKEA founder left Sweden for Switzerland. According to an NBER study, when entrepreneurs leave, employment drops 33%, investment drops 22%, and tax payments drop 51%.

Read that again: tax payments dropped 51%. The very revenue these taxes were supposed to generate evaporated because the wealthy are mobile—but the jobs they abandon aren’t. Middle-class workers get left holding the bag.

France tried to plug loopholes so hard they ended up exempting wine from the wealth tax. When your tax code has to carve out exceptions for Bordeaux, you’ve already lost.

Newsom’s Warning

At a Bloomberg News event in San Francisco, Newsom broke with his party’s progressive base and said what everyone who’s been paying attention already knows.

Newsom even called out Google co-founder Sergey Brin by name, expressing “disappointment” at his departure. But can you blame Brin? Reports indicate he terminated or moved 15 California LLCs in just 10 days before Christmas 2025. Larry Page did the same. According to Chamath Palihapitiya, $1 trillion of the $2 trillion in billionaire wealth has already left California.

This is a Democratic governor acknowledging that a Democratic tax proposal will destroy California’s tax base. The top 1% pay 46% of California’s taxes. The top 5% pay 66%. What happens when they leave? Everyone else pays—or services collapse.

The question isn’t whether capital will flee—it already is. The question is whether California will learn from Europe’s mistake before it’s too late.

Follow @garrytan for more.

Related Links

-

Sergey Brin's California LLC terminations (@teddyschleifer)

-

Chamath on $1T wealth exodus from California (@chamath)

Comments (0)

Sign in to join the conversation.