California Is Killing the Golden Goose

The Robinhood CEO says he loves this state. That’s why his warning should terrify Sacramento.

Robinhood CEO Vlad Tenev on California: 'I love what it represents... But it's becoming an increasingly more difficult place to do business.' The full interview is worth watching - this isn't an exit threat, it's a wake-up call from someone who wants to stay. Video: Full Send Podcast via @TheChiefNerd

Source: x.com

Robinhood CEO Vlad Tenev on California: 'I love what it represents... But it's becoming an increasingly more difficult place to do business.' The full interview is worth watching - this isn't an exit threat, it's a wake-up call from someone who wants to stay. Video: Full Send Podcast via @TheChiefNerd

Source: x.com

TL;DR

California faces an $18 billion deficit despite $8.6 billion in unexpected revenue. The problem is structural, and the toolkit is empty.

We need accountability and government competence in California. That’s not a partisan talking point—it’s the assessment of the Robinhood CEO who explicitly says he loves this state and isn’t leaving.

Archived tweetWe need accountability and government competence in California https://t.co/JkbVvwnIDl [Quoting @TheChiefNerd]: 🚨 Robinhood CEO Vlad Tenev Says California is ‘Becoming an Increasingly More Difficult Place to do Business’ “The fiscal health not good. I think it's a structural problem. I don't think one time taxes will fix the problem … We pay so much in taxes, and the schools and the infrastructure are mediocre at best.”

Garry Tan @garrytan February 06, 2026

Vlad Tenev isn’t threatening an exodus. He’s warning about complacency. And he’s invoking the oldest fable in economics: the goose that laid the golden egg. “That’s kind of what’s going on here,” he said on the Full Send podcast. California has the founders, the entrepreneurship, the tech economy—and Sacramento seems determined to squeeze it until something breaks.

$18 Billion in the Red Despite Record Revenue

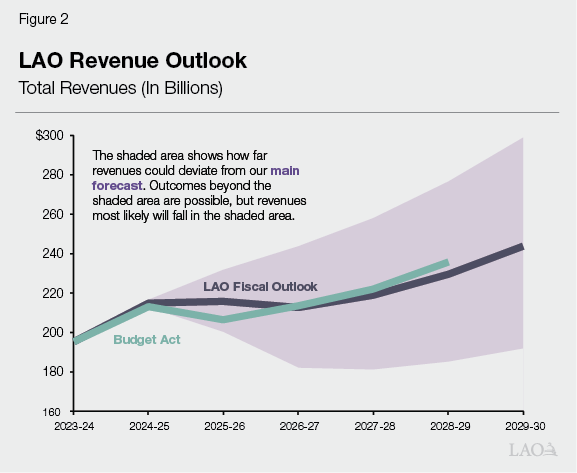

Here’s the math that should keep every California politician awake at night: the state is $8.6 billion ahead of revenue projections—and still faces an $18 billion deficit. How is that possible?

The answer is structural. Proposition 98 and Proposition 2—constitutional requirements for schools and reserves—absorb nearly all revenue gains automatically. As CalTax put it: “Constitutional spending requirements… almost entirely offset revenue gains.” We’re not just running a deficit during a downturn. This is the fourth consecutive year of deficits during a period of revenue growth. That’s not bad luck. That’s a spending problem disguised as a revenue problem.

The Goose That Laid the Golden Egg

Tenev’s warning cuts to the bone: “We pay so much in taxes, and the schools and the infrastructure are mediocre at best.”

That’s not anti-California rhetoric from someone planning to bail. He said explicitly: “I love California… I obviously intend to stay and push for this. California to actually become the best place to do business in the country.” He’s not calling for tax cuts. He’s calling for results. “I don’t think one-time taxes will fix the problem,” he said. “The problem is on a structural level.”

The question isn’t whether tech people love California. Many of us do. The question is whether Sacramento will keep pushing until even the people who want to stay can’t justify it anymore.

The Toolkit Is Empty

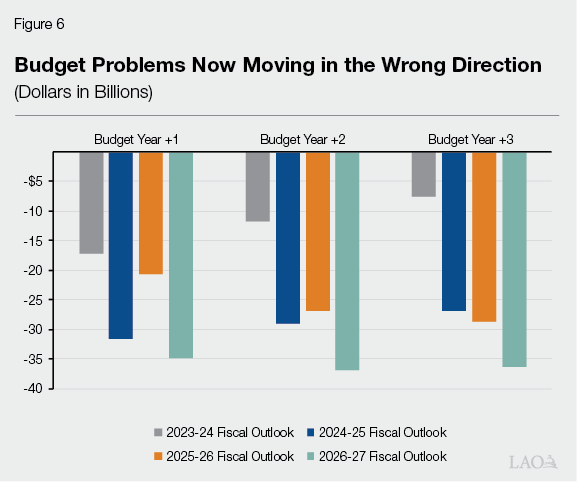

California has solved budget problems before—$27 billion in 2023-24, $55 billion in 2024-25, $15 billion in 2025-26. But it did so using one-time fixes: internal borrowing, spending down reserves, suspending tax credits.

Those tools are gone. Reserves are at half their peak. Over $20 billion in budgetary borrowing has already been tapped. Starting in 2027-28, structural deficits are projected to hit $35 billion annually.

The LAO’s warning is stark: “Continuing to use temporary tools—like budgetary borrowing—would only defer the problem and, ultimately, leave the state ill-equipped to respond to a recession or downturn in the stock market.”

The Tech Founders Fighting to Fix California

Here’s what too many Sacramento politicians don’t understand: the tech founders complaining loudest are the ones who want to stay and fight. They’re backing moderate candidates. They’re funding accountability campaigns. They’re demanding competence, not threatening departure.

The top 1% pay 46% of California’s taxes. The top 5% pay 66%. These aren’t people looking for handouts. They’re people with standing to demand results.

It feels wrong to talk about new taxes on wealth or anything else while the money already collected is being stolen. State capacity is destroyed when dollars get sent to NGOs and contractors that steal the money. The only antidote is much more auditing of government spending.

Vlad Tenev isn’t threatening to leave. He’s staying to fight. That’s what makes his warning so important: the people who love California the most are telling Sacramento the status quo is unsustainable. The answer isn’t more taxes on people already paying billions. It’s demanding results for the money we already spend.

Accountability. Competence. Actual outcomes.

California has the revenue. Now it needs the leadership to use it.

Related Links

-

The 2026-27 Budget: California's Fiscal Outlook (California LAO)

-

Vlad Tenev Talks GameStop, Stock Market Under Trump & the Future of AI! (Full Send Podcast)

Comments (0)

Sign in to join the conversation.