California Finally Upgrades 1990s Tech, Saves Millions

For years, the state bled $20M/month in EBT fraud using ancient systems. The fix took chip cards and AI—things we’ve had for a decade.

Source: gov.ca.gov

Source: gov.ca.gov

TL;DR

California cut EBT fraud by 83% after finally upgrading from 1990s-era magnetic stripe cards to chip-and-tap technology—the same protection credit cards have had since 2015.

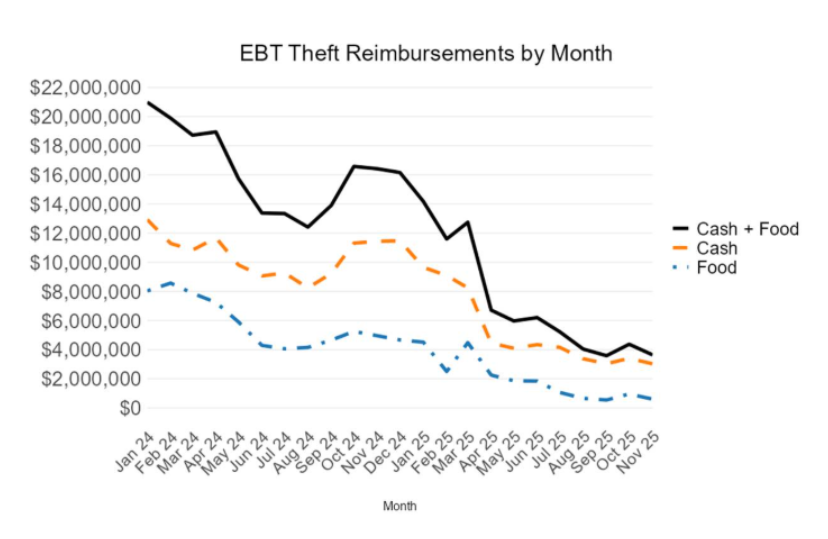

The numbers are staggering. California was losing over $20 million every single month to EBT fraud because the state’s benefit cards were still running on magnetic stripe technology from the 1990s. Thieves with $50 skimming devices were draining accounts belonging to the state’s most vulnerable families—and it took until 2025 for the government to deploy the same chip technology that your credit card has had for a decade.

Archived tweetNEW: California is seeing a major drop in fraud & theft with EBT food and cash benefits. Data shared first with us show CA went from losing up to $21 million a MONTH as of last January down to about $3.6 million now, an 83% decline. https://t.co/igmoSAPEDa

Ashley Zavala @ZavalaA January 16, 2026

The good news: it worked. According to the Governor’s office, California went from reimbursing victims $20.9 million in January 2024 to about $3.6 million by November 2025—an 83% reduction. The state was the first in the nation to launch chip-and-tap-enabled EBT cards, distributing approximately 4 million new cards by April 2025.

The Technology That Finally Worked

The fix wasn’t some moonshot innovation. It was basic fraud prevention that the private sector figured out years ago.

Beyond the chip cards, the state also deployed an AI-powered machine learning model that reduced fraud detection time from 2 months to just 72 hours—a 95% improvement. The model correctly identifies theft 82% of the time and saved 2,160 staff hours annually through automation.

Forced PIN resets for compromised cardholders reduced theft by roughly 80% among those accounts. Law enforcement coordination has resulted in 190 arrests since February 2023 and the seizure of hundreds of skimming devices.

The Uncomfortable Question

Here’s what should make taxpayers furious: as NACS reported, as of mid-2025, only California and Oklahoma had plans to transition to chip EBT cards. The USDA has called chip technology “a critical step in enhancing SNAP benefit protection” because chip cards are harder to copy. This wasn’t new information—it was widely known. The technology existed. Other states still haven’t acted.

Credit and debit cardholders have had chip protection since 2015. Why did it take California until 2025 to protect its poorest residents with the same technology? That’s a decade of preventable fraud—billions in stolen benefits that could have fed families.

The lesson here isn’t that government modernization is impossible. It’s that when government finally decides to act like the private sector—deploying modern technology, using data science, moving with urgency—it actually works. The question is why it takes so long to get there.

Follow @garrytan for more.

Related Links

-

California reduces theft of food and cash benefits by 83% (Governor of California)

-

Combating EBT theft with data and machine learning (Office of Data and Innovation)

Comments (0)

Sign in to join the conversation.