The NIMBY Millionaire Behind California’s Asset Seizure

Robert Reich earns $13,000/hour to denounce capitalism while blocking affordable housing in his own backyard. Now he’s pushing a tech-killing wealth tax.

TL;DR

The public face of California’s proposed wealth tax made $385,529 teaching one class per semester while blocking affordable housing near his Berkeley mansion — the same man now pushing an unrealized gains tax that would destroy tech startups.

The public face of California’s proposed “wealth tax” has made a career denouncing capitalism to wealthy audiences while collecting taxpayer-funded salaries and blocking affordable housing in his own backyard. A new Pirate Wires investigation exposes the staggering hypocrisy of Robert Reich, the 79-year-old Berkeley professor who’s become the hired gun for what amounts to a tech industry kill switch.

Archived tweetAnti-American Asset Seizure Tax, from the people who brought you Be-a-NIMBY-in-Berkeley style virtue signaling. It's not just a wealth tax. It's an unrealized gains tax to kill tech, a mass seizure of startup founder supervoting shares, AND a double dip tax on post-tax assets! https://t.co/fS0JGXjOJO https://t.co/ONxYNlPMyC [Quoting @PirateWires]: NEW IN PIRATE WIRES: Meet the millionaire NIMBY behind California’s proposed “wealth tax.” While billionaires and political reps have dominated headlines about the proposed asset seizure, the measure’s leading proponents have escaped deeper scrutiny. Today, we’re changing that. Robert Reich, 79-year-old Emeritus Professor of Public Policy at Berkeley, is essentially a hired gun on behalf of the unions and academics who crafted the asset seizure proposition. He spent the Carter years at the FTC, advised three U.S. presidents, and served as Clinton’s Labor Secretary before settling into academia... and along the way, he discovered a more lucrative calling: charging six-figure speaking fees to denounce capitalism for wealthy audiences. He fashions himself as a champion content creator of the working class, but a deeper look reveals a more complex picture. Robert is a political insider whose anti-capitalist rhetoric sits uneasily beside his own grizzled perch in one of America’s wealthiest enclaves — along with his record of thwarting affordable housing in his own neighborhood. Read the full story from @AJ_Odyssey 👇

Garry Tan @garrytan January 28, 2026

This isn’t just a wealth tax. It’s an unrealized gains tax designed to kill tech, a mass seizure of startup founder supervoting shares, and a double-dip tax on post-tax assets.

The $13,000-Per-Hour “Champion of the Working Class”

Reich has positioned himself as a champion content creator of the working class. The numbers tell a different story.

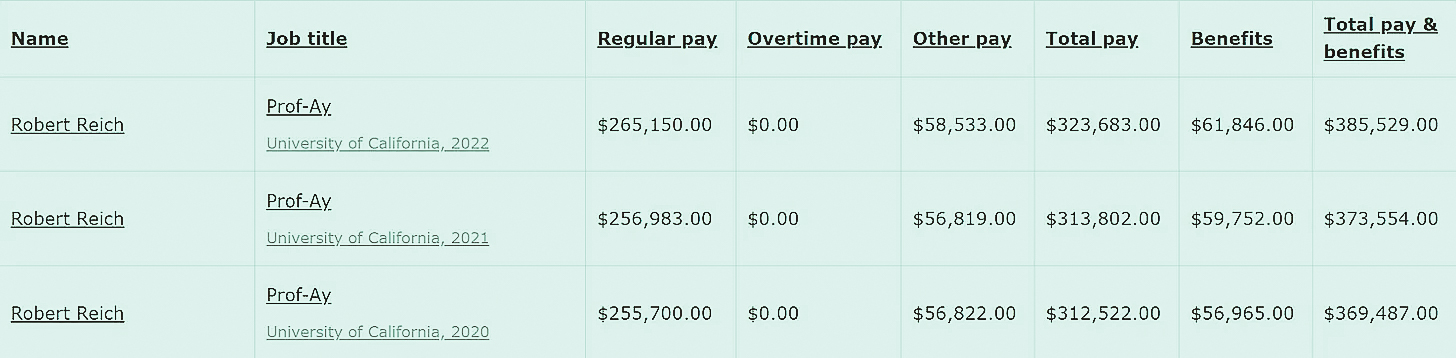

In 2022, Reich earned total pay and benefits of $385,529 while teaching just one class per semester at Berkeley. The Pirate Wires investigation breaks down the math: the class met once a week for two hours, translating to roughly $12,959 per hour. Not exactly the working-class wages he champions in his viral videos.

The income streams don’t stop there: books, documentaries with seven-figure domestic grosses, YouTube ad revenue from 1.43 million subscribers, and pensions from 11 years of federal service, 11 years at Harvard, and 7 years at Brandeis University. Reich’s colleague Emmanuel Saez — one of the architects of the asset seizure ballot measure — earned $349,350 in 2014, about $475,000 in 2025 dollars. Berkeley itself ranks in the top 5% of US cities for income inequality. These are the people telling you billionaires are the problem.

When Housing Came to Berkeley, Reich Said “Not In My Backyard”

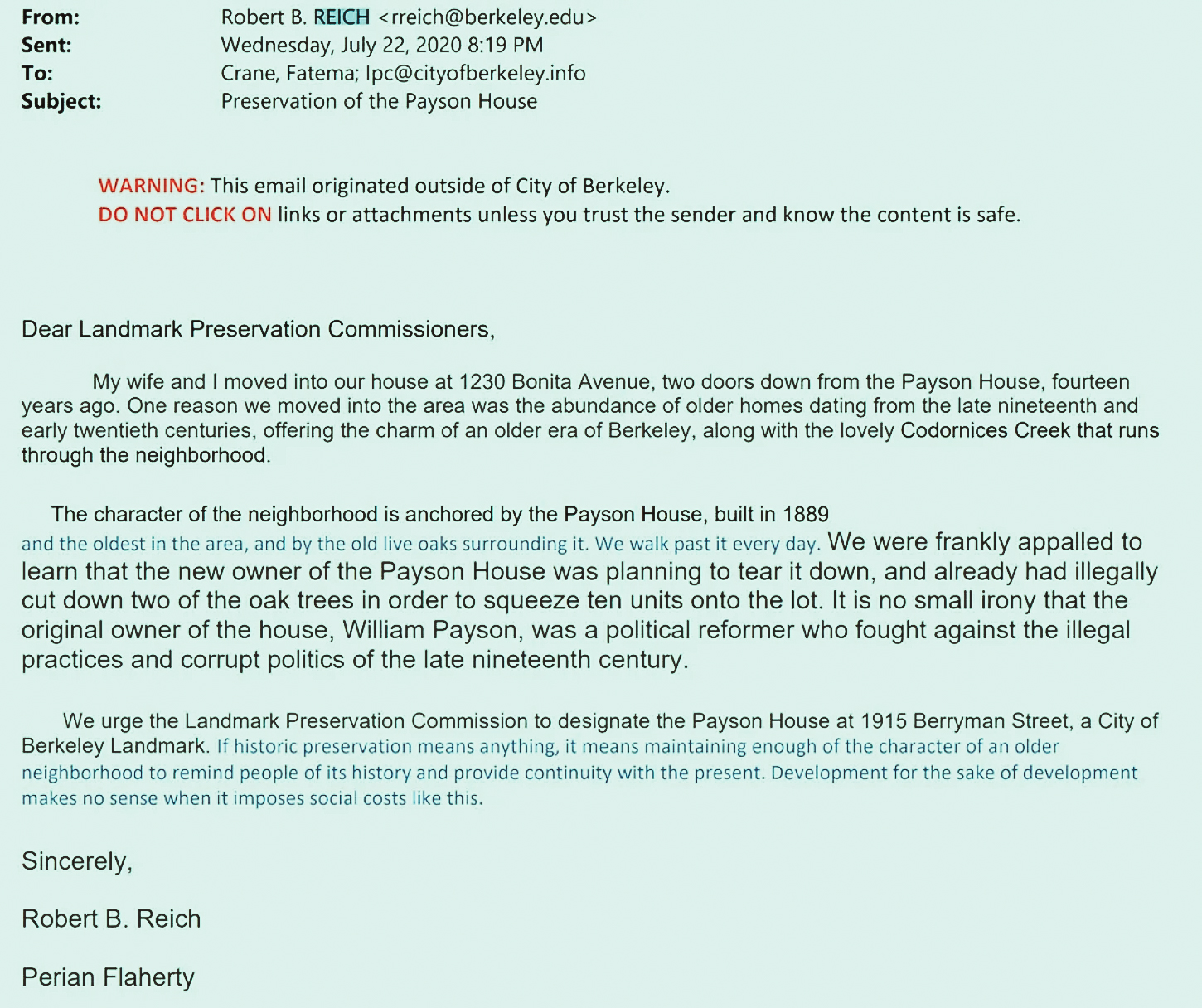

Perhaps the most revealing detail about Reich comes from the summer of 2020, when a local real estate company proposed a housing development near his Berkeley home — a project that included low-income rentals.

Reich opposed it. His justification? “Maintaining enough of the character of an older neighborhood to remind people of its history.” The property at 1915 Berryman Street was a complete teardown — Google Maps it yourself.

The connection between housing and tech battles isn’t coincidental. As noted previously: “Legalize building startups in California. Legalize building housing in California. Legalize building smart young minds in California. It’s all the same people against these things. The tools: onerous and Byzantine zoning, taxes, certifications, regulations.”

Not Just a Tax: A Tech Industry Kill Switch

The proposed ballot measure isn’t what it appears. As Pirate Wires reported, the language was quietly amended to redefine “net worth” so founders are taxed on assets they control via supervoting shares — not just wealth they actually possess. It punishes innovators for maintaining control of their companies.

The math is devastating: a unicorn startup founder becomes a paper billionaire around $5B valuation. At YC, that happens 2-4 times per year. Under this tax, that founder — still illiquid, still unable to sell — would instantly be on the hook for $100 million in taxes.

Max Levchin put it bluntly: taxing unrealized gains will “decimate California’s future tax base: early employees and founders of tech startups” because no one would start a company in California if a wealth tax dictates when they must sell. Larry Page and Peter Thiel are reportedly already making moves to leave the state.

Reich represents a class of political insiders who’ve built careers attacking capitalism from within its most comfortable institutions. The real question isn’t whether he believes his own rhetoric — it’s whether California voters will see through the populist packaging to recognize an asset seizure that would drive tech innovation out of the state while leaving its architects comfortably ensconced in their multi-million-dollar Berkeley properties.

Follow @garrytan for more.

Related Links

-

California's Tech Industry Kill Switch (Pirate Wires)

-

Garry Tan on housing and tech battles (@garrytan)

-

Max Levchin on unrealized gains tax (@mlevchin)

Comments (0)

Sign in to join the conversation.