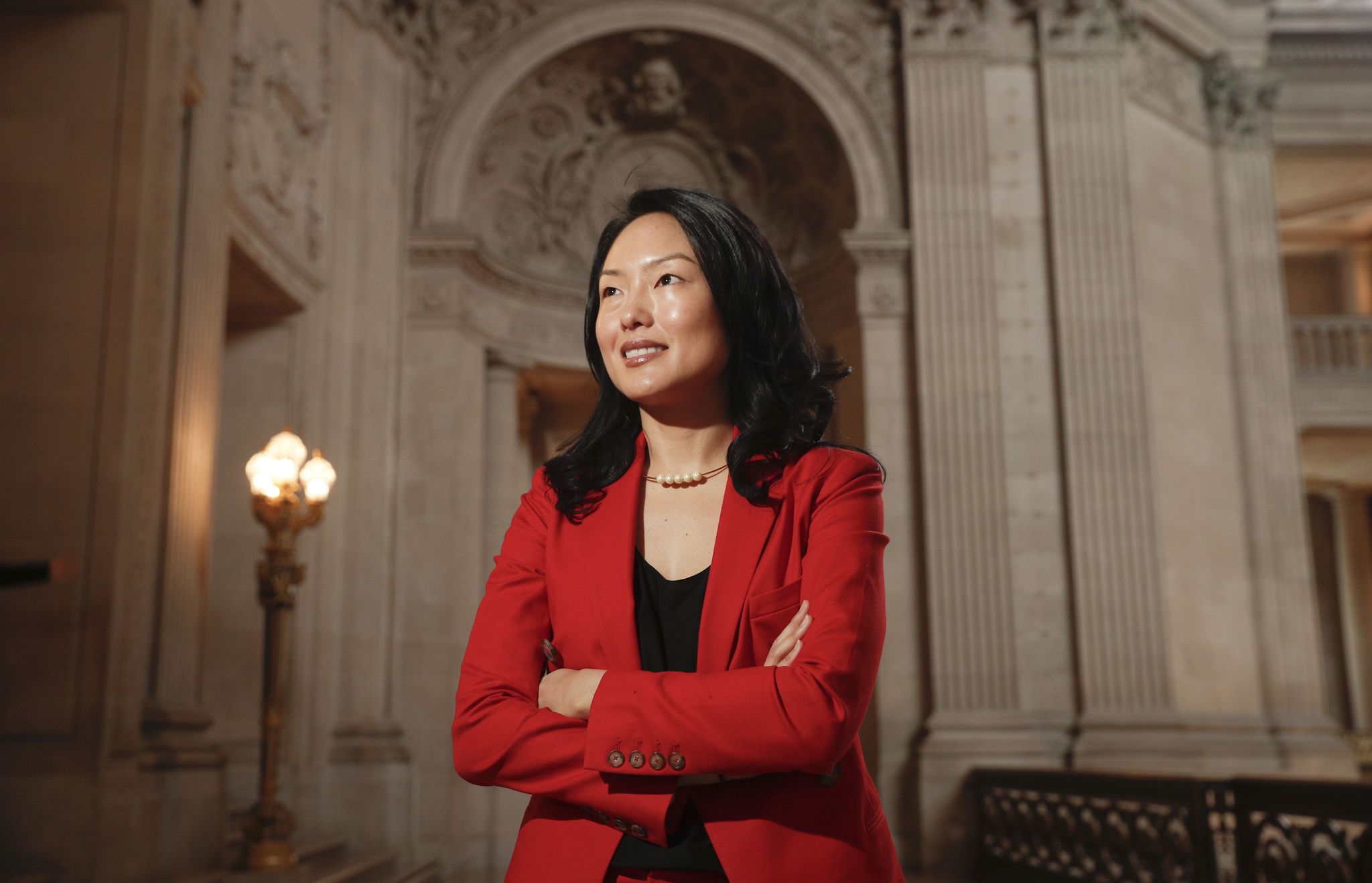

Jane Kim: From Killing Housing to Killing Insurance

The progressive politician who blocked 495 homes now wants to run California’s insurance market into the ground.

TL;DR

Jane Kim, who blocked 495 units of housing in SF after losing her political races, is now running for California Insurance Commissioner with policies that could drive the remaining insurers out of the state.

Jane Kim made a career of blocking housing in San Francisco. Now she wants to run California’s insurance market with the same playbook—more government control, more regulation, and policies that could drive the remaining insurers out of a state already in crisis.

The TODCO Track Record: 495 Units Killed

After losing to Scott Wiener in the state Senate race and London Breed in the mayoral contest, Kim didn’t disappear from San Francisco politics. She became a crony for TODCO—one of the most corrupt NIMBY nonprofits that tries to stop all housing from being built.

Archived tweetJane Kim killed 495 units of housing in a transit corridor after failing out of politics in 2021, becoming a crony for TODCO, one of the most corrupt NIMBY nonprofits that tries to stop all housing from being built Now she wants to make home insurance an even bigger mess in CA https://t.co/TD8pXF9uIu [Quoting @kimmaicutler]: Welp, this is one way to drive the rest of the home insurers out of the state. https://t.co/picBXKboZZ

Garry Tan @garrytan January 24, 2026

Kim blocked 495 units in a transit corridor—exactly the kind of location where we should be building housing. This is SF politics distilled: an industry where “preventing things from existing” is a senior role. Kill housing supply, blame landlords for the shortage you created, and somehow fail upward.

The Insurance Scheme: More Government, Fewer Insurers

Now Kim wants to bring this winning formula to California’s insurance market. According to the Chronicle, her campaign launched with three “bold proposals” that would get the government even more involved in making home insurance available—including having the state become an insurer itself.

Here’s the problem: insurers are already fleeing California. State Farm and Allstate haven’t written new home insurance policies in nearly three years. Other insurers have raised rates or dropped customers to reduce their risk exposure. The last thing this market needs is someone threatening to cap profits and create a government-run alternative.

Kim-Mai Cutler summed it up perfectly:

Archived tweetWelp, this is one way to drive the rest of the home insurers out of the state. https://t.co/picBXKboZZ

Kim-Mai Cutler @kimmaicutler January 24, 2026

Kim’s response to this crisis? “We should take their threat very seriously,” she told the Chronicle, “and that means we have to explore public options.” Translation: double down on the policies that created the problem.

The Progressive Playbook: Spend More, Get Less

This is the same ideology that spent $2.5 billion on homelessness and increased it by 50%. The same mindset that’s driven tech and innovation out of California with hostile policies. The same playbook that’s turning the Golden State into the Golden Exit.

Kim launched her campaign with an endorsement from Bernie Sanders, who called her “a bold and thoughtful leader” and “the clear choice for insurance commissioner.” That tells you everything you need to know about where this is heading—more government control, more mandates, and the same results San Francisco got from progressive housing policy: less supply and higher costs.

California’s insurance market is already in crisis. The last thing it needs is someone whose greatest accomplishment was preventing 495 homes from being built. Voters should look at Kim’s record in San Francisco and ask: do we want those results for California’s insurance market?

Follow @garrytan for more.

Related Links

-

Garry Tan on Jane Kim's TODCO record (@garrytan)

-

Kim-Mai Cutler on Kim's insurance proposals (@kimmaicutler)

Comments (0)

Sign in to join the conversation.