California’s Tax Suicide: Who Pays When Billionaires Flee?

The top 10% fund 76% of the state budget. Sacramento’s answer? Chase them all away.

TL;DR

California’s proposed wealth tax threatens to trigger mass capital flight, and when the top 10% who pay 76% of taxes leave, everyone else picks up the tab.

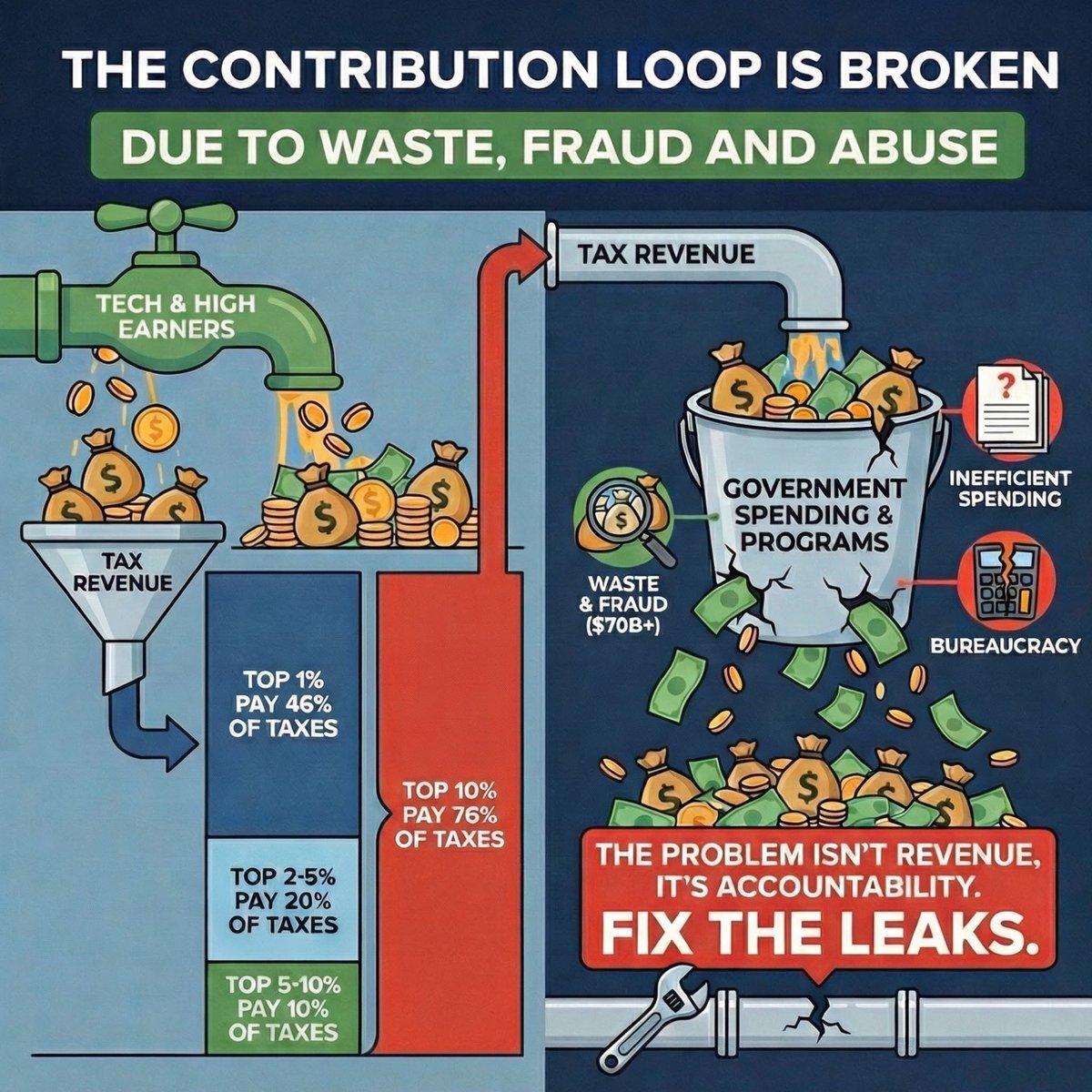

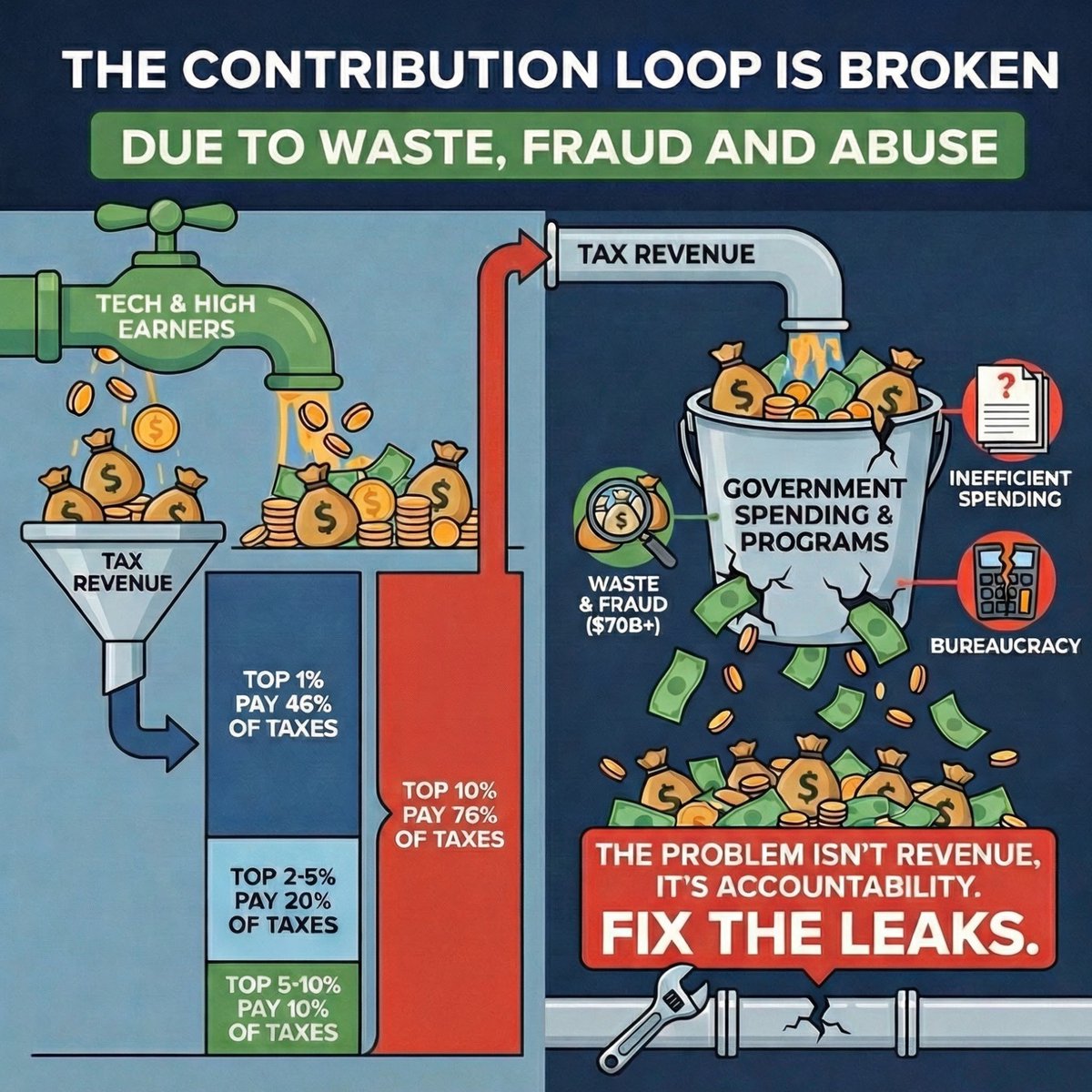

The numbers are stark: the top 1% of Californians pay 46% of all taxes. The top 10%? They cover a staggering 76% of the state’s tax revenue. Now Sacramento wants to impose an asset seizure tax that will send these people running—and everyone left behind will pay the price.

Archived tweetThe top 1% pay 46% of taxes The top 2-5% pay 20% of taxes The top 5-10% pay 10% of taxes What happens when you have mass asset flight due to the threat of asset seizure? Who pays then? Everyone. It destroys California. https://t.co/P5kmgD9rQK https://t.co/Hq9bczrFLy [Quoting @tommyclarke]: Thank you @garrytan and @JaredWalczak, very interesting and a great read. Residency based on only a single day snap shot seams shady, additionally the one-day tax taxable net worth even if the resident is no longer a resident, wow. Just muddy waters, by design. How do you feel this will go down and target the middle class? Once the billionaires leaves, which total combined have a 2 trillion dollar worth and 1.5 trillionaire of a tax base has already left California. The consequence is the taxes are going to have to come from somewhere if this is the states tax model. This makes absolutely no sense at all, this is a gross overreach and not only are people being forced out, but these actions make California non-investable. What’s next, being taxed on investing in a California company? That would kill all start ups and more, just terrible. Do not spend your time fighting in Cali people, there are other states that are welcoming for tech, head to Austin or Miami.

Garry Tan @garrytan January 17, 2026

The “one-day snapshot” residency rule is particularly insidious. Get caught in California on January 1, 2026? Congratulations—you’re on the hook for a wealth tax on assets you may have accumulated over decades, even if you leave the state the very next day. As the quoted tweet puts it: “Just muddy waters, by design.”

The Exodus Is Already Happening

This isn’t hypothetical doom-and-gloom. According to the CA Wealth Exodus tracker, approximately 47 billionaires have already fled California, taking roughly $882 billion in wealth with them. That’s an estimated $13.2 billion in lost annual tax revenue—gone. The departures read like a tech hall of fame: Larry Page ($274.7B), Sergey Brin ($253.4B), Peter Thiel ($29.4B), David Sacks ($2.0B).

And it’s about to get worse. A Pirate Wires survey of 21 billionaires in the largest billionaire Signal chat found that 70% of California billionaires will leave if the ballot prop passes. Every founder of a private company mentioned concerns about the “control” language in the proposal.

The Tax Foundation’s Damning Analysis

The proponents claim it’s “just 5%” on wealth above $1 billion. But Jared Walczak of the Tax Foundation has shown this is a lie. Due to intentional drafting choices, founders with Class B shares get taxed on voting interests that exceed their actual economic stake. Assessment rules for private businesses lead to massive overvaluations. Valuation floors ignore economic distress. The effective rate is far higher than advertised.

“Leave Before the B”

Here’s the chilling phrase now circulating among founders: “Leave before the B.” The fear isn’t just among billionaires—it’s spreading to anyone building something that might become valuable. Replit founder Amjad Masad has openly said the tax is making him consider leaving. The SF Standard reports the backlash is “spreading far beyond billionaires.”

UC Berkeley economist Enrico Moretti warns: “the losses will exceed the benefits.”

What happens when you chase out the people funding the schools, the roads, the social programs? You don’t get a socialist paradise. You get a state that can’t pay its bills. And the middle class—the people who can’t just pack up and move to Austin or Miami—they’re the ones who get crushed.

California politicians need to understand something fundamental: if you create an environment where tech and innovation isn’t welcome, you will get less and less of it. Once the mass asset seizures begin, the Bay Area might still be where things start—but it won’t be where they stay.

Stop the Golden Exit before it destroys us all.

Follow @garrytan for more.

Related Links

-

CA Wealth Exodus Tracker (CA Wealth Exodus)

-

Tax Foundation Analysis of Wealth Tax (@JaredWalczak)

-

Pirate Wires Billionaire Poll (Pirate Wires)

-

'Leave Before the B' Backlash Spreading (SF Standard)

Comments (0)

Sign in to join the conversation.